Crafting A Killer Startup Story For Your Fundraising Pitch

Your company narrative is hiding inside the walls of your company’s brain, it’s a matter of drawing it out. Now let’s outline the steps and process, including all of the specific techniques used to arrive at your company’s killer narrative.

Co-Authored with Ryan F. Salerno, Technical Co-Founder at Equity Token.

Earlier this year, in response to the question “What are the most common mistakes founders make when they start a company?”, Justin Kan, the Founder of Twitch & Atrium, responded with the following:

“Mistake 1: Underestimating the importance of narrative when fundraising:

I firmly believe that investors invest in (and employees join, and journalists write about) compelling stories, and your pitch deck is really just a vehicle for telling the story you want to tell. So, start first with the narrative and build the deck after you have it nailed.”

Finding Your Killer Company Narrative:

You need a killer company narrative for your startup pitch. Wether you are telling your family about your company or speaking with investors while fundraising, how you communicate your company’s narrative matters.

From a pure story perspective, how do you do that? Let’s quickly introduce two frameworks we will be using.

Framework 1: Story of Stories

With this question in mind, I was recently reading a series of new posts called The Story of Us from one of my favorite authors, Tim Urban. In it, he breaks down the specific characteristics required for a normal story to become a story virus. Those characteristics are:

Simplicity

Unfalsifiability

Conviction

Contagiousness

Accountability

Comprehensiveness

Framework 2: Startup Focus

Jonathan Greechan, Co-founder of the Founder Institute, has a presentation on Startup Focus. According to Jon, your startup must do the following:

To arrive at your killer company narrative, you need a startup story that is simple and unfalsifiable, while also fitting the “Solve One Problem for One Customer” framework.

Here’s an example company narrative if Stripe were to go through this exercise.

Securely collecting credit and debit card payments is hard for developers. With the Stripe Checkout Product, developers can embed a payment form that costs $0.30 per transaction.

Your narrative is hiding inside the walls of your company’s brain, it’s a matter of drawing it out. Now let’s outline the steps, including all of the specific techniques used to arrive at a killer company narrative.

Step 1 - Prepare:

Over the course of a few days start brain dumping any and all talking points you currently associate with your company into your notepad.

Schedule a “Narrative Day” with your whole team. Find a conference room and book a day on the calendar with no other meetings, so you can focus on this project.

Buy the following supplies before the meeting and be sure to bring them with you:

Post-it Super Sticky Wall Easel Pad, 20 x 23 Inches ($30 on Amazon)

Different Color Sticky Post It Notes ($6 on Amazon)

Color Coding Stickers ($5 on Amazon)

Markers

As I mentioned above this process was inspired by Tim Urban’s “Story of Stories” framework. I highly recommend having your team read this post in advance of your company’s narrative revision meeting.

Step 2 - Brainstorm:

Stick up five sheets of the sticky wall easel pads around the room. Going left to right label each of them as follows:

Original Company Vision

Current Narratives

Goals For New The Narrative

New Potential Narratives

Target Customers

Hand out the sticky post-it notes to your team. If you want, you can give each person their own color so you can later easily see who contributed what ideas.

Start with the first board “Original Vision” by having each person on your team write down a sentence (small enough to fit on a sticky note) that describes your company’s original vision. Originally, when your company was an idea over beers, what was the initial pie in the sky dream for the vision?

Each person should write as many as they can think of in a few minutes. After time is up, everyone puts up their stickies on the wall and someone reads them out loud.

Step 3 - Vote & Sort:

Next, use the dot sorting technique. Give each person on the team a bunch of the green and red dot shaped stickers. It is now time to upvote and downvote the Original Vision board to determine which company narratives are resonating with your audience / customers.

Each person should place a green sticker on the ideas they want to upvote as resonating with your audience / customers.

Each person should place a red sticker on the ideas they want to downvote as resonating with your audience / customers.

Now rearrange the post it notes so the ideas with the most upvotes are on top, and the idea’s with the most downvotes are on the bottom!

You now have a clear and glanceable look at what is working and what is not with regard to your original vision for the company.

Step 4 - Repeat For Each Section:

Repeat this process for the remaining boards. Letting every team member contribute ideas and then helping to vote them up/down.

Current Company Narratives

What does the website say right now? If you asked someone else to describe your company back to you, what would they say? Write down an honest depiction of the current narrative.

Goals For New The Narrative

What do you want to achieve, given this new narrative? Hiring more employees? Signing up more customers? Getting more revenue? Getting more funding? A better brand? Whatever it is, write out all the goals.

New Potential Narratives

Brainstorm as many new potential narratives as you can think of. At this point there are still no wrong answers, so don’t filter yourself. Let the ideas flow and allow the dot voting take care of bringing the strong ideas to the top.

Target Customers

Who are going to be your initial target customers? Get as specific as possible. E.g. Startup founders running companies from Seed to Series A.

With the completion of each board, you will see a pattern start to emerge. Granting you a more focused and evolving clarity into how you need to structure your communications going forward.

Step 5 - Forcing Focus:

Remember those frameworks we introduced above. We are now going to apply them as filters to the narratives we just defined.

Sharing two more slides from Founder Institute Co-founder Jonathan Greechan’s presentation around focus for startups:

Put another sheet of the sticky wall easel pad on the wall and add the following to it, with room to write in answers under each:

One Problem

One Customer

One Product

One Killer Feature

One Revenue Stream

This template may seem obvious at first but as any founder can attest; the large magnitude of possible product features you can build, conflicting feedback, and more can sometimes feel burdensome. No body wants a bloated startup pitch. This structure is going to help you focus in on your specific startup’s niche.

Step 6 - The Story of Stories:

In Step 5 you defined your Focus, and now in Step 6, make sure your focus fits all of the criteria of being a killer company narrative.

This is where we come back to the Story of Stories. In the post Tim defines few necessary characteristics of a viable story virus:

Simplicity. The story has to be easily teachable and easily understandable.

Unfalsifiability. The story can’t be easy to disprove.

Conviction. For a story to take hold, its hosts can’t be wondering or hypothesizing or vaguely believing—the story needs to be specific and to posit itself as the absolute truth.

Contagiousness. Next, the story needs to spread. To be spreadable, a story needs to be contagious—something people feel deeply compelled to share and that applies equally to many people.

The story, once believed, needs to be able to drive the behavior of its host. So it should include:

Incentives. Promises of treats for behaving the right way, promises of electroshocks for behaving the wrong way.

Accountability. The claim that your behavior will be known by the arbiter of the incentives—even, in some cases, where no one is around to see it.

Comprehensiveness. The story can dictate what’s true and false, virtuous and immoral, valuable and worthless, important and irrelevant, covering the full spectrum of human belief.

Some great examples of strong story virus include Santa Claus and Catholicism. It is important you have an understanding around these characteristics as we are going to apply them as filters in the next step.

I recommend writing these characteristics down on another sticky wall easel pad so everyone in the room can clearly see the criteria that needs to be met.

Step 7 - Fill In The Blanks:

So we know have all of the following information at our disposal:

Original Company Vision

A understanding of what our company set out to do in the first place.

Current Narratives

What is currently working and not working.

Goals For New The Narrative

How we want to improve the company’s narrative pitch.

New Potential Narratives

The best candidates for our startups’ new story.

Target Customers

Defined segment of target customers.

Knowledge around what makes a good story in the first place

A solid template to force focus.

The next step is to fill in the blanks on the Problem, Customer , Product, Killer Feature, Revenue Stream template board.

The key here is to keep your answers for each to only a few carefully chosen words and to ONLY fill in the blanks with words that meet all of the requirements of the story virus.

String each of the answers together to form one sentence! Just like that Stripe example above.

Securely collecting credit and debit card payments is hard (PROBLEM) for developers (CUSTOMER). With the Stripe Checkout Product (PRODUCT), developers can embed a payment form (KILLER FEATURE) that costs $0.30 per transaction (REVENUE MODEL).

You now have your company’s new narrative!

Step 8 - Go Spread The Gospel

Start pitching your new startup story and see if it is resonating better than before. This process can help immensely when your company is fundraising. If you are like any of the companies I have seen use this process so far, then you should immediately start to see the benefits from this one day team exercise. Remember:

“Genius is the ability to put into effect what is on your mind.”

- F. Scott Fitzgerald

Other Founder Guides you might find helpful:

More on Tim Urban:

You may know Tim Urban from his famous TED Talk “Inside the mind of a master procrastinator”. On his website, Wait But Why, his articles tend to break down complex topics such as Artificial Intelligence, Elon Musk’s Neuralink, Religion, E-mail, Marriage, and so much more, to very simple explanations. So when Tim didn’t publish anything new for 3 years, many readers wondered what he was possibly working on. The answer was a new series of posts titled “The Story of Us”. If you have read and loved Sapiens by Yuval Noah Harari, then I recommend you check out The Story of Us: Full Series!

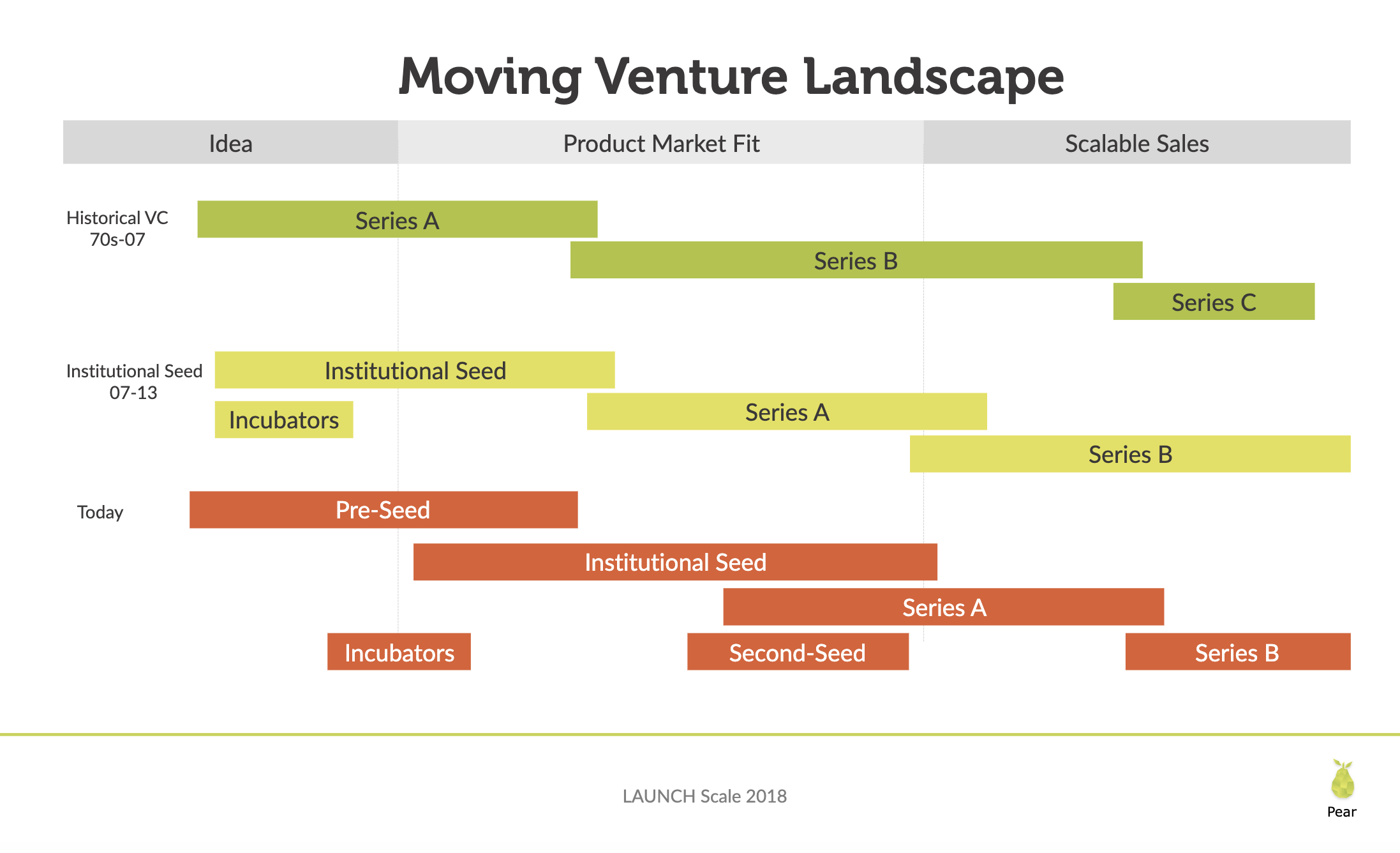

The Venture Capital Fundraising Landscape

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

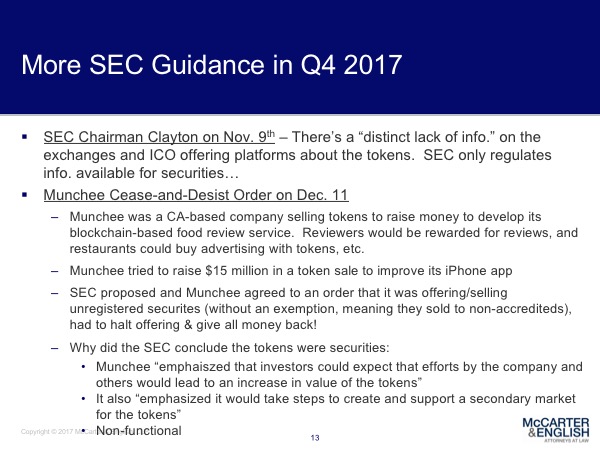

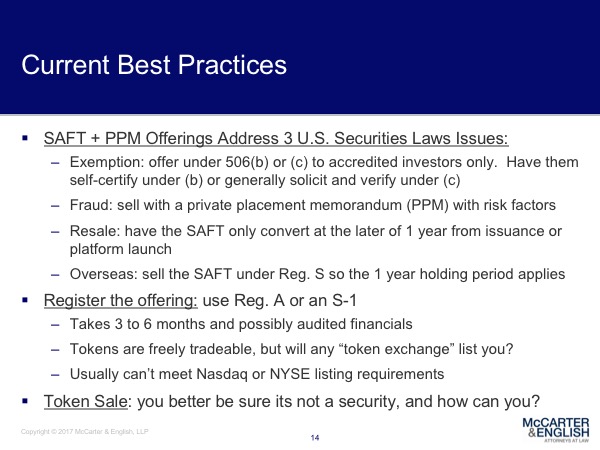

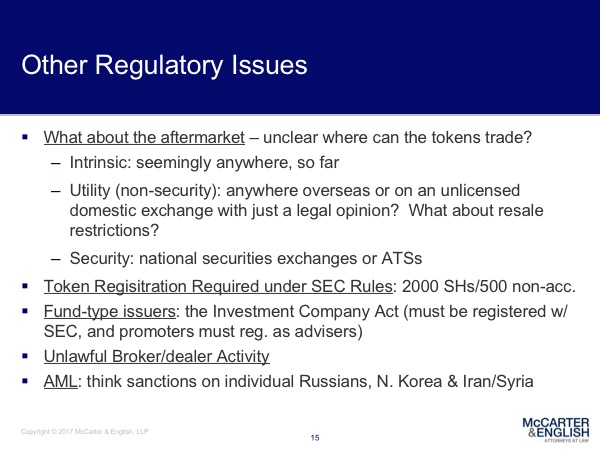

LIVE EVENT! Cryptocurrency, ICO, & Blockchain Law in 2018 with Joe Daniels of McCarter & English

This episode comes to you from the heart of New York City for our first live podcast episode discussing cryptocurrency, ICO, & blockchain law!

Joe Daniels, Co-Chair of McCarter & English Venture Capital & Emerging Growth Companies practice

This episode comes to you from the heart of New York City for our first live podcast episode discussing cryptocurrency, ICO, & blockchain law. In late January almost 100 founders gathered at the offices of McCarter & English for our January Founder Institute Meetup! The crypto founders there heard from Joe Daniels, who is the Co-Chair of the McCarter & English's Venture Capital & Emerging Growth Companies practice. Joe has worked on numerous SAFT & token offerings, including San Francisco based Quantstamp, which just raised $30 million in its pre-sale, along with Augmate, The Valorem Foundation, RealECoin, VIMarkets, CoinBoost, and RecylcleGO.

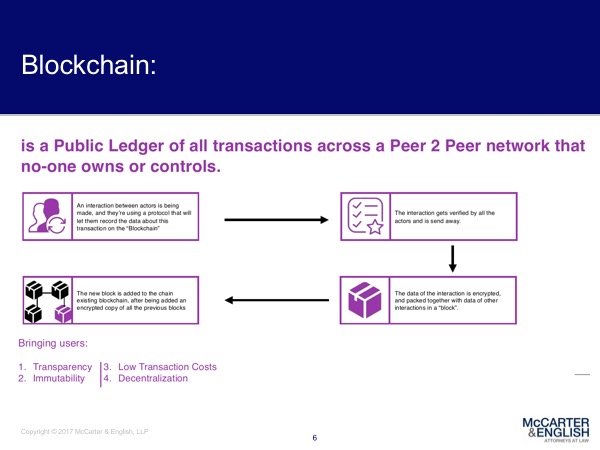

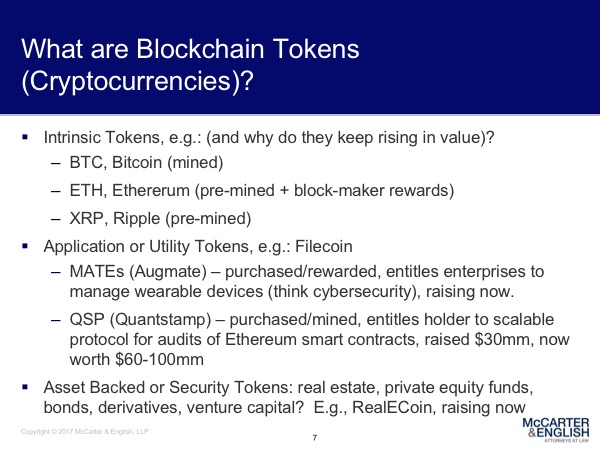

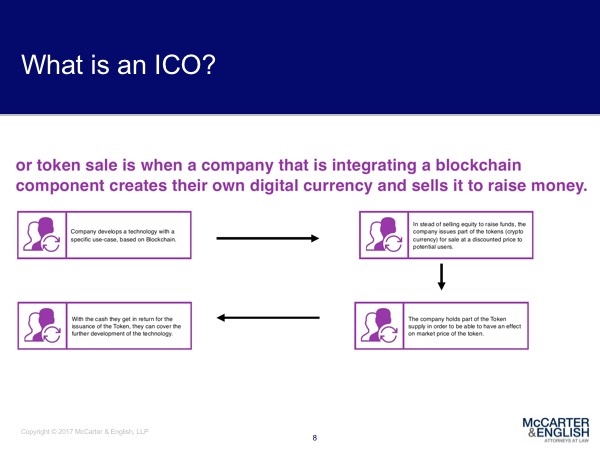

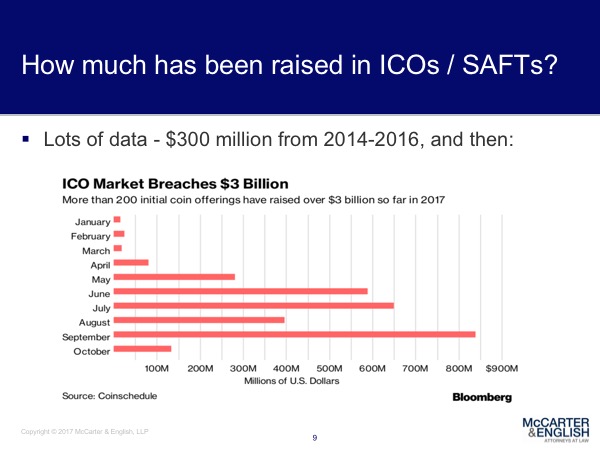

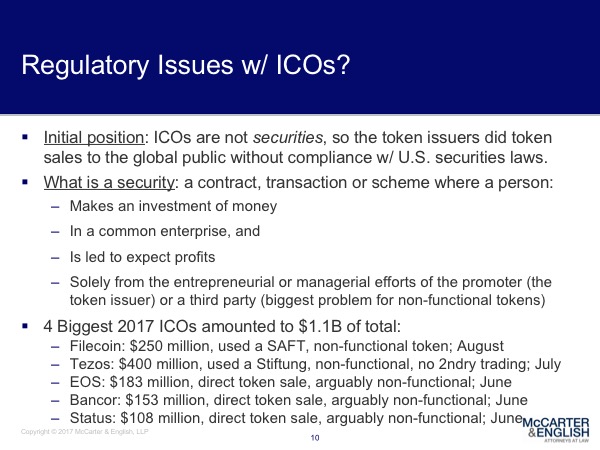

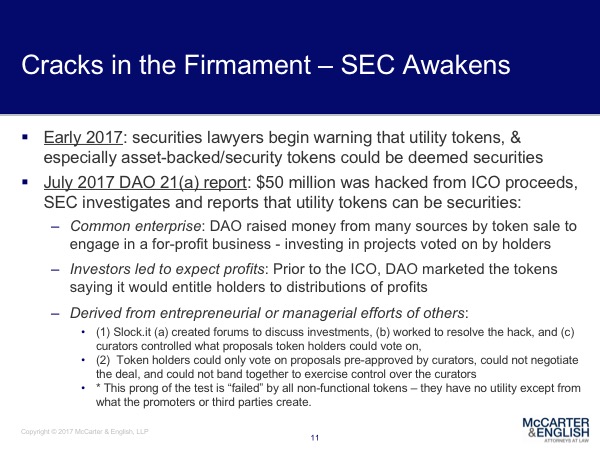

During this event, Joe reviewed the current cryptocurrency, blockchain, & initial coin offering laws in 2018. Learn the key things that you need to know about ICO's, the SEC, international business, SAFT agreements, and more. If you are interested in understanding the legalities around cryptocurrencies, tokens, and the blockchain, then you will definitely enjoy this episode. The slides that Joe is going over during his presentation are available below if you want to follow along. They are packed with information, such as:

What are Blockchain Tokens (Cryptocurrencies)

What is an ICO

How much has been raised in ICOs / SAFTs

How do SAFT agreements work

Regulatory Issues w/ ICOs

The SEC's response to the emergence of cryptocurrencies

Current Best Practices for cryptocurrencies

Follow Along With All The Slides From The Event:

Listen to this episode now:

Join the shows A-list backchannel for exclusive access to additional Ambition Today content, deeper guest insights, a community of fellow fans, and much more. Plus, Learn the single greatest piece of advice this guest has ever learned!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

You can find the full transcript of this episode here.

Be sure to listen and subscribe to the show on your favorite podcast platform.

What Is Blockchain? What You Need To Know About Bitcoin, Ethereum, NFT’s, And Crypto

With Coinbase officially adding over 100,000 new accounts per day, I have started to get a lot more questions about Cryptocurrency and Bitcoin in general. My goal with this post is to provide people with a starting point to best get up to speed on the space, fast!

Old coins from the Roman Empire

It is a long journey down the rabbit hole of Cryptocurrency to truly understand everything that is going on within the blockchain space (and how it is affecting other industries). But it is not an impossible task, and you have to start somewhere. With Coinbase officially adding over 100,000 new accounts per day, I have started to get a lot more questions about Cryptocurrency and Bitcoin in general. My goal with this post is to provide people with a starting point to best get up to speed on the space, fast!

I first heard about Bitcoin in 2012 while writing daily Tech news for the Launch Ticker. I believe it was priced around $10, but I didn’t understand Bitcoin at the time, so I didn’t buy any. Then, in 2013, Bitcoin became what I would refer to as "Silicon Valley / Venture Capital" mainstream. Which in hindsight, I think we in the industry sometimes forget just how early to new ideas and industries we can be. Even still I did not buy any bitcoin. Even with everyone talking about something, it can be so easy to dismiss the things we don’t understand. And so, as Wayne Gretzky once famously said, "You miss 100% of the shots you don't take."

So two years later I took a deeper look at Bitcoin and I started to understand how it all works before buying some. I went down the rabbit hole; reading blog posts, sub-reddits, listening to podcasts, de-mystifying the blockchain, smart contracts, etc.

Which brings us to today. If 2016 and 2017 have taught us anything, it is that we are in a new era where awareness outpaces execution. In my opinion, social media and the connectivity of smartphones has no problem getting people talking about the hot topics of the day or week on the surface. But we are flooded with so much information that it has become harder to filter what is worth stopping, taking the time to learn more, and going deep on a subject.

And so today, my advice is to take some time to understand Cryptocurrency and it's surrounding technologies. Whether or not you are a believer in Bitcoin, Ethereum, or any other cryptocurrency, the technologies that have enabled this revolution, such as the blockchain, are almost certainly here to stay. I am going to lay out some information, which should help you gain a deeper understanding around the whole industry. I would recommend digesting them in the order I present them in, and remember to keep an open philosophical mind:

Understand Why We Have Money and How It Works Today:

Yuval Noah Harari, Author of the book Sapiens, explains how civilization came to have money over the course of evolution in this TED talk: "Why Humans Run The World". I recommend watching it all, but skip to 10:45 in the video if you want to fast forward to the money part.

This video on Money and Finance from John Green's youtube channel Crash Course is a super quick refresher on how our modern day monetary systems work. It even briefly mentions how Bitcoin has played a role as it has emerged over the past few years.

Bitcoin:

Banking on Bitcoin is a 2017 documentary currently on Netflix. The first 20 minutes will give you a great overview on how Bitcoin ad the technology around it works. With the rest of the film covering the history of cryptocurrency, regulation of the industry, who is Satoshi Nakamoto, the dark web, and how people have used Bitcoin to date. It features interviews with enthusiasts and experts, this documentary covers Bitcoin's roots, its future and the technology that makes it tick.

Blockchain:

The Blockchain is actually explained somewhat simply during this TED talk by Lorne Lantz.

In this episode of the Tim Ferris Show "The Quiet Master of Cryptocurrency", he is joined by Naval Ravikant (who you will also see in Ethereum TechCrunch talk below with Vitalik Buterin) and Nick Szabo (who you might remember from the Banking On Bitcoin documentary above).

This episode goes much deeper into the world of cryptocurrency. You will learn about how the blockchain works, the history of smart contracts, what a Merkle Tree is, the importance of decentralization, and so much more!

In this video from Wired, Blockchain researcher Bettina Warburg explains the blockchain in every age from a child up through graduate school. It then ends with a great conversation with another Blockchain expert.

Lastly with regard to the blockchain, if you click the button below you can see a step by step visual demo of the blockchain in action. I highly recommend clicking through the demo to better understand how blockchains work.

Ethereum:

At age 19, Vitalik Buterin, created Ethereum in 2013. To think about it simply, Ethereum is similiar to Bitcoin but it also allows developers to deploy code and software programs on it's blockchain.

Ethereum is a decentralized platform that runs smart contracts; applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference. These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property.

Buying Bitcoin and Cryptocurrencies:

The easiest way to get started with cryptocurrencies is by creating an account on Coinbase.

After signing up you will be provided with your own digital wallet, which is stored in the cloud, on Coinbase’s servers. This is important to note because you are trusting a third party to protect your wallet. There are other digital wallet alternatives if you would prefer to not store your cryptocurrency on Coinbase, such as storing your wallet on your computers hard drive or on an external Zip drive. Whichever you choose, be sure to pick a wallet that is secure. Using Coinbase you can buy Bitcoin, Ethereum and Litecoin.

Important Note: Be sure to ALWAYS use two factor authentication. Do not use SMS based two step verification as your phone number can be stolen depending on your phone company. To understand why this is important and learn some more security tips to secure your digital wallet, I recommend reading Cody Brown's article "How to lose $8k worth of bitcoin in 15 minutes with Verizon and Coinbase.com".

If you are looking to get involved with more Crypto Assets & Currencies I am linking to some getting started guides below:

A Beginners Guide To:

Bitcoin Cash

Ethereum

Ethereum Tokens

Monero

Litecoin

0x

Tezos

Decred

Zcash

For more cryptocurrencies you can check out Coin Market Cap to see what else is out there. Clicking on a currency on Coin Market Cap will show you more information about it, including historical prices, as well as tell you the available exchanges you can buy from.

ICO's:

Be wary of Initial Coin Offerings of new tokens. Many new coins that are being created are simply not needed in my opinion. Especially if the same function or utility could be done using an already existing cryptocurrency.

If you do find a crypto currency you like, then you need to evaluate the whole project, just like you would if you were investing in an early stage startup. Make sure you research the amount of money being raised, what the token does, the valuation that the project actually works and is live, the team behind it, etc. Just how with early stage startups, only the top 5% of companies are worth investing in, the same is true of ICO’s. Most ICO's will likely fail. Fred Wilson, has a good blog post on how to carefully evaluate these new crypto assets.

White Papers:

White papers lay out the foundation for how a crypto asset works and what principles it relies upon. In the world of crypto, they are similar to the pitch decks that startups put together today or a traditional business plan, and they are typically shared with the public. To really get a good understanding of what they look like, I am including the original Bitcoin white paper wrote by Satoshi Nakamoto and the Ethereum white paper.

Hard Forks:

Forks happen when a blockchain splits in two, going forward from a certain date. The main cause of a hard fork is because of a new rule that gets created by a certain portion of the community. This can create another currency if the new network is stable enough to sustain itself after the fork. Being as both the old and the new currencies share the same ledger history, customers with balances of the original currency at the time of the fork now have an equal quantity of the new currency. You can read more about forks here and the few most successful forks to date are:

Bitcoin Cash - Forked from Bitcoin on August 1st, 2017.

Bitcoin Gold - Forked from Bitcoin on October 25th, 2017.

Ethereum Classic - Forked from Ethereum in 2016.

Regulation And Sustainability:

Being as regulation can be quite complex, I am going to simply link out to some additional reading materials in this section.

State Regulations:

China

Singapore

South Korea

Historical Incidents:

Mt. Gox: In 2014, 850,000 bitcoins, worth $450 million at the time, had disappeared or been stolen by hackers.

DOA: In June 2016 an anonymous hacker exploited a critical flaw and stole $31 million in Ether in a few minutes.

Energy Consumption:

High Energy Consumption:

Low Energy Consumption:

Wall Street

J.P. Morgan

Futures Contracts

The Future of Cryptocurrency:

I encourage you to clickthrough and view all of the slides Chris Burniske, Author of Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond, has put together. I have shared the first slide and my favorite slide below:

DISCLAIMER: These are just my personal thoughts and resources. I hope it helps you learn about the cryptocurrency industry so you can better make your own decisions. Be sure to do your own thorough diligence before making any financial decisions. Always invest responsibly.

How To Send Your Monthly Investor Updates

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master.

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master. Sending monthly investor updates is one of the best ways for a founder to maintain their existing connections and strengthen their new ones.

Long-term relationships are built with friends, family, and colleagues by staying close and in touch over long periods of time. It is so important that you still keep in contact with the people you want to stay close too, even when you think you don't have value to add or need something in the exact moment. One of Founder Institute New York’s mentors, Matt Rodak talked about the importance of sending monthly updates while building his startup company, Fund That Flip on an Ambition Today episode recently.

Benefits of Sending Investor Updates Frequently:

While this may seem overly simple at first glance, I assure you that many people take basic communication for granted and avoid the little bit of work it involves each month. For those that do send monthly updates, there are several non-obvious benefits aside from your company's business updates.

Being Top Of Mind:

Even if you don't get a response, it keeps you on top of people's mind. That next meeting your investor has, they might bring you up while you are fresh on their mind.

Creating Stronger Relationships:

Mark Suster has famously been quoted as saying people "Invest in Lines, Not Dots". Keeping in touch is how you build a long-term and enduring relationship. It's been that way since the caveman days and hasn't changed. It's human psychology.

Assuring Company & Personal Health:

Most of the time that investors don't hear from a founder they assume their startup company is dead or well on its way. Or worse, they just forget about you entirely. You just fade away from their memories, replaced by fresher memories of other startup founders. Before the internet, this was a given. In the world of social media though, we take this for granted as many feel that "online presence" is enough. I assure you, that unless you are Mark Cuban, it is not.

Gaining Insights & Reflection:

The process is insightful. Taking a moment to send someone an update on your life or business forces you to take a moment and reflect on the progress you have made in the last 30 days. In our busy lives, it is critical to make that time. As an additional bonus, you will be more productive and make better-informed decisions in the coming month as well.

Formatting:

So what should you include in your startup’s investor updates? You can find plenty of investor update examples and how-to articles that already exist when you google “Monthly Investor Updates." I am going to include links to many of my personal favorites below! There are many different styles of monthly investor updates, but most involve the same essentials.

Dear Kevin,

I hope you had an excellent August! For us it has been a mixed month, but we’re happy to report these developments.

Cash: Money in Bank and Monthly Expenses

Highlights:

KPIs:

Customers Update

Useful Graph, Image, or Screenshot

Employees/Team Changes

The Good:

The Bad:

Asks

Thank You's

Thank you,

Kyle

CEO, ACME Corporation

Monthly Investor Update Templates & Examples:

There are so many great investor update examples and investor update templates from some really amazing investors and founders: I collected some of the best investor update templates below for you:

A “Fill-In-The-Blank” Investor Update Template for Busy Founders - Micah Rosenbloom

13 Investor Update Emails That Turned Our Dots Into A Line - Reza Khadjavi

The Why and How Of Updating Your Angel Investors - Dharmesh Shah

What Should I Include In My Monthly Investment Update? - Jason Calacanis

So at the end of this month take even just one hour to send a monthly update. You should keep your update short and to the point. Think about what you have accomplished in the last month and what you need help achieving in the next month. Think about the people in your life that mentor and guide you. Hopefully, you already have them on a mailing list. And then send your update. You will be AMAZED at the compounding effects you will receive from putting monthly updates out there!

Joe Fairless' Journey From Madison Avenue To An $85 Million Real Estate Portfolio

In keeping with last weeks' real estate theme, Episode 25 of Ambition Today finds us across the table from Joe Fairless, Real Estate Investor and Host of the Best Real Estate Investing Advice Ever Show.

In keeping with last weeks' real estate theme, Episode 25 of Ambition Today finds us across the table from Joe Fairless, Real Estate Investor and Host of the Best Real Estate Investing Advice Ever Show. Joe set his roots in advertising after a bit of soul-searching during his undergrad years at Texas Tech. Fighting complacency, he left Madison Ave. for the allure of real estate investing and entrepreneurship, and was met with incredible success, with due credit to his persistence and work ethic.

Owing his early sense of drive to his start in landscaping, Joe Fairless has always had an entrepreneurial mindset. After leaving his teenage lawn-mowing business, J&J Landscaping, Joe tried to cling to his high school football career by attending a junior college near his home town of Dallas. After transferring, he went on to graduate with a degree in advertising and quickly rose through the ranks of executive marketing, while investing in real estate as a side project and finding passion in that venture. Joe applied his trademark tenacity to his newfound love of investing and now controls approximately $85 million worth of rental property. Kevin digs into the factors behind Joe's success, and much more:

The seemingly hidden on-ramp of landscaping as a teenage job to eventually invest in real estate.

Exploring passions during college to find what interests you.

Applying lessons from the corporate world to an entrepreneurial startup.

Leaving a comfortable job to pursue your real dreams.

How to break into the shark-infested waters of commercial real estate.

The 75/25 rule of listening/asking when approaching mentors.

Acknowledging your strengths.

Acknowledging your weaknesses and surrounding yourself with people who help make up for them.

The grit of making your ambition come to life.

Ambition Today Question of the Day™:

"As a thought leader, how does ambition play a role in your life?"

Quote Of The Episode:

"Don't get caught up trying to be everywhere at once, find the platform that makes sense for your skill sets and what you enjoy doing. Then own it." - Joe Fairless

“Be different before being incrementally better.” - Joe Fairless

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

How Matt Rodak Plans To Fund Every House Flip In America with Fund That Flip

Any amount of research into the seemingly eternal-growing market of real estate investment will almost surely make one familiar with Matt Rodak, Founder and CEO of Fund That Flip.

Matt Rodak

Any amount of research into the seemingly eternal-growing market of real estate investment will almost surely make one familiar with Matt Rodak. The 2007 John Carroll grad is the founder and CEO of Fund That Flip, a company which allows anyone to apply for fast and affordable funding in the rehabilitative real estate investment business. The New York based startup had already raised $2 million by April 2016, shortly after graduating from Manhattan's Entrepreneur Roundtable Accelerator in the summer of 2015 and Founder Institute New York prior to that. Fund That Flip finds its niche by bridging the gap between accredited investors and vetted real estate rehab projects in the U.S.

On this episode of Ambition Today, Matt Rodak discusses his seemingly inevitable entrepreneurial roots (despite his "best efforts") as the son of a business owner. He explains how his relationship with his father, and him owning his own company before and during college, led to Matt's on-again, off-again kinship with business ownership. Today, Matt capitalizes on the experiences of his youth by taking action to solve the problems he notices in his industry, such as streamlining the loan application process for prospective "flippers". We hear about his journey to where he is, his advice on how to get there, and much more:

Maturing in an entrepreneurial-spirited family.

Paying for college by advancing a teenage lawn-mowing gig to a profitable business that he was able to sell during his sophomore year at JCU.

Being introduced to the real estate market through his early exposure to landscaping.

What to study in college vs. what to leave to education via real-world experience.

Bringing an entrepreneurial spirit to a non-entrepreneurial position at a large business.

Using lessons from upper management to implement starting a business.

Creating a business to streamline and eliminate the fallacies of market norms.

Employing the JOBS Act to capitalize on a brand-new industry.

Ownership vs. Accountability in life.

Ambition Today Question of the Day™:

"How do you align the ambitions of your team with the ambitions of the company?"

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

Jesse Middleton Talks Building WeWork Labs And Investing With Flybridge Capital

Over the years WeWork has grown to become an $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Jesse Middleton

Over the years WeWork has grown to become a $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Early on with entrepreneurial parents, Jesse learned that he did not have to take the traditional path in life and that he could forge his own future. He started to do just that, as he founded his first company before even going to college. Fast forward to Fast Company magazine once comparing Jesse to Jack Dorsey, then onto his time building WeWork Labs, and now his time as a VC at Flybridge. Jesse has a great story full of many lessons, such as:

Recognizing at an early age the ability to create your own path in life.

The importance of keeping a clear focus at the early stages of a new company.

How Jesse founded WeWork Labs.

Just get started and go.

The lessons from actively helping grow a $16 billion company.

Why long term vision is so important for the founders of companies.

What is next for WeWork Labs.

The intersection of community building and being an investor.

The future of Venture Capital.

Ambition Today Question of the Day™:

“What does Ambition mean to you and how has it driven you?”

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

Startup Of The Week: TeddyMozart

The Startup Of The Week I have selected for the week of May 30th is Teddy Mozart. The first smart toy dedicated to connecting families across the world to share love and inspire growth in young children through music.

I am starting a new blog segment called the "Startup Of The Week", or S.O.T.W.™ for short, where I plan to highlight some great startups. There are several startups working to make the world a better place and I want to tell you a little bit more about some of them.

The Startup Of The Week I have selected for the week of May 30th is TeddyMozart.

Company: TeddyMozart

Founder: Carlton Bennett, Founder & CEO

Headquarters: Brooklyn, New York Operating: Globally

One sentence pitch: The first smart toy dedicated to connecting families across the world to share love and inspire growth in young children through music.

In my words: The app technology and the plush bear that come together to make TeddyMozart, create a unique experience that allows a child and family member to feel connected in a fun, loving, engaging and playful way.

In their words: “Families can use the TeddyMozart app and easily record and store a family's traditional songs, lullabies and stories from anywhere and share it with young children from generation to generation, forever. Young children get to listen to these musical experiences through the comfort of a high quality TeddyMozart plush toy.”

Accomplishments:

Who is product for:

- Family members who believe in preserving their voice through memories.

- Parents who want to set the mood or inspire kids with a song.

- Busy parents who like to set playlists of songs unique to their child's daily routine.

- Family members wanting to provide a unique and memorable gift experience.

- Parents who want to provide a great companion for their kids.

How It Works:

If you want to learn more about the company or team behind this week's Startup Of The Week you can contact me here.

2016 Startup Funding Trends With Adeo Ressi

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Adeo Ressi at Valley in Berlin 2016

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Alex Konrad recently gave us some insight on Ambition Today and now today we have a more in-depth explanation of what is happening from Adeo Ressi, the founder of the Founder Institute. Last month Adeo was in Germany for the "Valley in Berlin Summit" and keynoted a talk around the 2016 Startup Funding Trends we are currently seeing. If you are thinking about fundraising, have a startup, or plan on starting your own company you are going to want to watch the keynote below.

Ambition Today: Alex Konrad of Forbes on Harvard, Media, and Startup Venture Capital

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Aside from our discussion around Kanye West's recent discovery of Twitter we explore Alex's journey to now. Alex grew up in New York City, then went on to write at the Harvard Crimson before working at Fortune. Alex now is a staff writer at Forbes and also works on the Forbes Midas List, ranking the top Venture Capitalists of the past year, and the Forbes 30 Under 30, highlighting up and coming creative and business people. Today we talk about Harvard, the future of media, startups and venture capital. We cover a lot in this episode. including:

Getting into Harvard.

Working for the Harvard Crimson news and editorial board.

Why empathy matters so much in today's world.

How Alex got his start at Fortune working on the Fortune 500.

The relationship between print and digital articles in 2016.

When to go outside your "swim lane".

How to become a real New Yorker?

The advantages of the New York Tech Scene.

Writing the Forbes Midas List and Forbes 30 Under 30.

How large tech companies grow global startup ecosystems.

What global cities are up and coming for startups.

Why are the Venture Capital markets slowing down.

The best way to get media attention for your brand.

Ambition Today Question of the Day:

How important is self marketing?

Links from this episode:

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

Ambition Today: Jeff Wald, Co-founder of Work Market, talks Harvard, NYPD, Venture Capital, Startups, and Mentoring

On episode eight Jeff Wald, Co-founder and President of Work Market and his incredibly charitable no shave Movember mustache join Ambition Today. "The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald, Work Market

On episode eight Jeff Wald, Co-founder and President of Work Market join's Ambition Today.

"The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald’s background is nothing short of impressive. He started at Cornell University and then went to J.P. Morgan. He then went back to school at Harvard for an MBA. After Harvard Jeff spent time at Glen Rock Group before going on to Co-found Spin Back. The wild ride of Spinback, his first startup, took Jeff to almost moving back home after coming close to running out of money. The answer was to rebuild the business which later ended up getting acquired. After acquisition Jeff went to Barington Capital Group, and finally to his current company where he is the Co-founder and President of Work Market. Did I mention he was also an auxiliary member of the NYPD as well? This is an episode packed full of insights:

Is getting a Master's of Business Administration worth the return on investment?

Should you start a company or get an MBA?

The value of spending time with Entrepreneurs.

How to break into Venture Capital.

Leaving a job in Venture Capital to start a new company.

How to attract high quality investors in your startups such as Fred Wilson from Union Square Ventures, Spark Capital, and Softbank.

The one question you should start every meeting with.

The four different types of conversations.

Differences between Advisors and Mentors.

The importance of giving back to others

The Ambition Today Question of the Day:

Who would win in a fight, Batman vs Superman?

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Links from this episode:

Work Market, Acquired by ADP

@JeffreyWald on Twitter

Why I Mentor by Jeff Wald in the Huffington Post

NYPD Blue -- What I Learned About Startups Patrolling the Streets of New York City by Jeff Wald in the Huffington Post

NYPD Auxiliary Officer program

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

How Startup Funding Works

If you have ever wondered how startup funding works and what it would be like to go through this process of raising venture capital and angel investor money to fund your startup, well wonder no more

Venture Dealr

Most entrepreneur's are constantly looking to get their startup funded, starting from the very time of conception. The reality is that funding is just one part of a startup's life. Team, product, and execution are almost always more effective and powerful tools in a founder's arsenal than only throwing money at the problems your company working to solve.

Let's say though, that for the sake of this post, you got your company off the ground and funded. You even attracted enough investors to raise a Series A, B, and C too. Nice work! Then, some time after that you even exited your company as well! Impressive, I think you have the hang of this startup thing.

If you have ever wondered how startup funding works and what it would be like to go through the process of raising venture capital and angel investor money to fund your startup, well wonder no more. Dan Lopuch and the team at Data Hero have created the "Venture Dealr". A pretty sharp Github project that allows you to visualize and turn the knobs on venture financing concepts such as dilution, option pools, liquidation preferences, down-rounds, and more. So go ahead, take your startup and shoot for the moon by clicking the button below.

Eric Duffy, CEO of Pathgather On What's Next For Learning Management & Startup Life In Silicon Alley

Eric Duffy, Co-Founder and CEO of Pathgather, a beautiful and engaging learning platform for the modern workforce joins us on episode 6 of Ambition Today. We get into the insights fast on this episode.

Eric Duffy, Pathgather

Eric Duffy, Co-Founder and CEO of Pathgather, a beautiful and engaging learning platform for the modern workforce joins us on episode 6 of Ambition Today. We get into the insights fast on this episode:

"What do I think will allow me to have the most impact on my short time on earth" - Eric Duffy

For Eric, after some time abroad in Africa, the answer to his question was to start Pathgather. We discuss how traveling the world can lead to inspiration for new great ideas. From there Eric moved back to Silicon Alley and joined the Founder Institute in New York to launch Pathgather. His journey through founding a startup takes us through:

How a great MVP tests user behavior and can attract your first customer.

Graduating the Founder Institute New York.

How to position yourself to enable meeting your Co-founder.

Joining Techstars New York City.

Disrupting a stagnate industry such as the Learning Management System (LMS) space.

Fundraising your seed round and how a convertible note works.

Attracting investors such as Bloomberg Beta, Contour Venture Partners, Techstars, The Vedas Group, Tigerlabs Ventures, Palm Drive Ventures, Jerry Wang, Thomas Wisniewski, and Michael Derikrava.

And also:

The Ambition Today Question of the Day:

What should a new startup founders first step be?

Todays News:

What are your thoughts on Twitter naming Jack Dorsey, one of its founders, as CEO?

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Ambition Today Podcast Sponsors:

Audible.com

Founder Institute

Tim Ferriss and Naval Ravikant Teach You About Life, Startups, And The Future

You have to live in the now in order to be happy. The key to the American Dream is balancing work and non work. The Information Age is undoing the industrial revolutions. Company sizes are shrinking and we are trending toward more and more people working for themselves. Time is more scarce then money, make sure you spend it wisely.

If you haven't listened to Tim Ferriss and Naval Ravikant recently on the Tim Ferris Show, you should. You can listen to it here:

Get ready to learn about life, startups, and the future. Some of my favorite quotes from the conversation were:

"You have to live in the now in order to be happy."

"The key to the American Dream is balancing work and non work."

"The Information Age is undoing the industrial revolutions. Company sizes are shrinking and we are trending toward more and more people working for themselves."

"Time is more scarce then money, make sure you spend it wisely."

Tim Ferris on each episode, deconstructs world-class performers from eclectic areas (investing, sports, business, art, etc.) to extract the tactics and tricks you can use.

Naval Ravikant is the CEO and a co-founder of AngelList, an online platform helping you find a great startup job, invest in a startup or raise money for your own startup. Naval has invested in Twitter, Uber, Yammer, Postmates, Wish, Thumbtack, and OpenDNS.

Casey Neistat's Startup Lesson

If you know Casey Neistat then you know in 2015 he has started doing a vlog a day. In vlog #112 Casey shares his new startup story about BeMe Inc and how he was in the middle of fundraising at the same time his child was being born.

If you know Casey Neistat then you know in 2015 he has started doing a vlog a day. In vlog #112 Casey shares his new startup story about BeMe Inc. and how he was in the middle of fundraising at the same time his child was being born. Check it out below and in my opinion if you want to consume the most important piece of advice Casey gives, go ahead and skip to 2 minutes 10 seconds.

The only thing in life that stands between you and everything you have ever wanted to do, is doing it - Casey Neistat

The Single Biggest Reason Why Startups Succeed

I was recently watching Charlie Kim, founder and CEO of Next Jump, presenting at the Founder Institute. During his talk he cited a TED talk by Bill Gross titled "The Single Biggest Reason Why Startups Succeed".

I was recently watching Charlie Kim, founder and CEO of Next Jump, presenting at the Founder Institute. During his talk he cited a TED talk by Bill Gross titled "The Single Biggest Reason Why Startups Succeed". I found the talk and enjoyed it so much I thought I would share it. You can find the link to it by clicking here.

Bill wanted to find out what is the single biggest reason startups succeed. He analyzed 200 companies. For each company he looked at the business traits of Funding, Business Model, Idea, Team, and Timing to determine which traits correlated most to its success. The quick synopsis is that the Bill Gross study showed that Timing (42%) is the single most important factor in a why a startup succeeds. Followed by Team (32%), Idea (28%), Business Model (24%), and lastly Funding at (14%).

What do you think? Agree? Disagree? Let me know in the comments below.