43North's $1 Million Investment Opportunity

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

Being born and raised in Buffalo, NY, I have always loved my hometown city. If you are curious about why, I recommend you check out “The Incredible History of Buffalo, NY In 5 Minutes”, which I shared in the Huffington Post a few years ago.

Scott Wayman of Kangarootime, after winning 43North in 2017

In 2014, Buffalo started 43North, investing $5M per year to attract and retain high-growth companies in Buffalo, NY. Fast forward to 2017, and after meeting Scott Wayman, the founder of Kangarootime, at a Founder Institute event in Silicon Valley, I recommended the company to 43North. Kangarootime ran with it and crushed it. First, securing an initial $500k investment from 43North, and then subsequently more follow on funding. They have since grown a significant presence in Western New York and continuing to build a great company!

Then in 2018, one of my Founder Institute New York portfolio companies, Teddy Mozart, received a large purchase order from QVC. A massive break, but they needed help financing the inventory to fill the QVC order. Carlton, the founder, told me he found Kickfurther, which secures inventory funding via their marketplace of investors. Through Kickfurther, Teddy Mozart managed to get the funds needed to fill the QVC order in less than 72 hours! I told this story while helping to deliberate the final investment decision in 2018, and I like to think it helped play a role in Kickfurther joining the 43N portfolio that year!

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

If you or someone you know might be a good fit, visit 43 North to apply, or feel free to text me at +1 (646) 907-6669 if you would like to connect directly about the opportunity!

The Next Chapter: Finta for Fundraising

Finta helps early-stage start-ups raise capital faster. Automating the fundraising process and streamlining the tedious, manual, step-by-step operations of a fundraise, while securing all of your important diligence documents in one place. Helping companies save time, raise more, and increase efficiency.

Anytime you close a chapter, you must always turn the page to a new one. In my next role, I am building Finta to continue my mission of helping founders.

Ten years ago, finding the information you needed to know about how to start a company, was not easy to find. A locked box of sorts, that only a privileged few had knowledge of, especially as it related to the business style of Silicon Valley tech companies.

Over the past decade, in order to be “value add” to their potential investments, many Venture Capitalists started to share company building information on their personal blogs. Then some organized that information into three-month-long programs and called them accelerators. Others gave their companies office space and called those incubators. Investments were layered in to further help these companies. Free podcast interviews with founders started to provide insight directly into the minds of business leaders. And on and on it went. The Silicon Valley mindset went global, and once-rare company building information has now become widely accessible to anyone online.

As a result, I have recently seen a shift in what the founders are looking for when starting a company. Information is wonderful, but now that it is widely accessible it is only a piece of the puzzle. In order to be true “Value Add” in this next decade, investors will need to help founders in new ways, beyond just information and money. I believe the best investors will do so by building software for founders.

I put an emphasis on “for founders” because some investors are already building/investing in software for investors. Widely missing the mark when it comes to how they perceive founder pain points. This is due to the fact that founders and investors live on two opposite sides of the traditional venture capital transaction. Resulting in investors becoming much better at buying equity, then founders are at selling it.

Going into this next decade, I believe building great software and platforms to truly help founders is going to be an important part of the puzzle when finding success as an investment firm. This is our motivation behind building Finta. Starting with fundraising, one of the most manual, tedious, and step by step process a founder has to execute. At Finta, we are automating the investment process for companies and issuers. They just set up their company and deal once on our platform. Share it with prospective investors and we will take care of the rest for them.

Finta helps early-stage start-ups raise capital faster. Automating the fundraising process and streamlining the tedious, manual, step-by-step operations of a fundraise, while securing all of your important diligence documents in one place. Helping companies save time, raise more, and increase efficiency.

I am extremely excited to build Finta. It’s a new chapter in my story, and I can’t wait to see what the future holds.

Check out Finta for yourself on our website!

Crafting A Killer Startup Story For Your Fundraising Pitch

Your company narrative is hiding inside the walls of your company’s brain, it’s a matter of drawing it out. Now let’s outline the steps and process, including all of the specific techniques used to arrive at your company’s killer narrative.

Co-Authored with Ryan F. Salerno, Technical Co-Founder at Equity Token.

Earlier this year, in response to the question “What are the most common mistakes founders make when they start a company?”, Justin Kan, the Founder of Twitch & Atrium, responded with the following:

“Mistake 1: Underestimating the importance of narrative when fundraising:

I firmly believe that investors invest in (and employees join, and journalists write about) compelling stories, and your pitch deck is really just a vehicle for telling the story you want to tell. So, start first with the narrative and build the deck after you have it nailed.”

Finding Your Killer Company Narrative:

You need a killer company narrative for your startup pitch. Wether you are telling your family about your company or speaking with investors while fundraising, how you communicate your company’s narrative matters.

From a pure story perspective, how do you do that? Let’s quickly introduce two frameworks we will be using.

Framework 1: Story of Stories

With this question in mind, I was recently reading a series of new posts called The Story of Us from one of my favorite authors, Tim Urban. In it, he breaks down the specific characteristics required for a normal story to become a story virus. Those characteristics are:

Simplicity

Unfalsifiability

Conviction

Contagiousness

Accountability

Comprehensiveness

Framework 2: Startup Focus

Jonathan Greechan, Co-founder of the Founder Institute, has a presentation on Startup Focus. According to Jon, your startup must do the following:

To arrive at your killer company narrative, you need a startup story that is simple and unfalsifiable, while also fitting the “Solve One Problem for One Customer” framework.

Here’s an example company narrative if Stripe were to go through this exercise.

Securely collecting credit and debit card payments is hard for developers. With the Stripe Checkout Product, developers can embed a payment form that costs $0.30 per transaction.

Your narrative is hiding inside the walls of your company’s brain, it’s a matter of drawing it out. Now let’s outline the steps, including all of the specific techniques used to arrive at a killer company narrative.

Step 1 - Prepare:

Over the course of a few days start brain dumping any and all talking points you currently associate with your company into your notepad.

Schedule a “Narrative Day” with your whole team. Find a conference room and book a day on the calendar with no other meetings, so you can focus on this project.

Buy the following supplies before the meeting and be sure to bring them with you:

Post-it Super Sticky Wall Easel Pad, 20 x 23 Inches ($30 on Amazon)

Different Color Sticky Post It Notes ($6 on Amazon)

Color Coding Stickers ($5 on Amazon)

Markers

As I mentioned above this process was inspired by Tim Urban’s “Story of Stories” framework. I highly recommend having your team read this post in advance of your company’s narrative revision meeting.

Step 2 - Brainstorm:

Stick up five sheets of the sticky wall easel pads around the room. Going left to right label each of them as follows:

Original Company Vision

Current Narratives

Goals For New The Narrative

New Potential Narratives

Target Customers

Hand out the sticky post-it notes to your team. If you want, you can give each person their own color so you can later easily see who contributed what ideas.

Start with the first board “Original Vision” by having each person on your team write down a sentence (small enough to fit on a sticky note) that describes your company’s original vision. Originally, when your company was an idea over beers, what was the initial pie in the sky dream for the vision?

Each person should write as many as they can think of in a few minutes. After time is up, everyone puts up their stickies on the wall and someone reads them out loud.

Step 3 - Vote & Sort:

Next, use the dot sorting technique. Give each person on the team a bunch of the green and red dot shaped stickers. It is now time to upvote and downvote the Original Vision board to determine which company narratives are resonating with your audience / customers.

Each person should place a green sticker on the ideas they want to upvote as resonating with your audience / customers.

Each person should place a red sticker on the ideas they want to downvote as resonating with your audience / customers.

Now rearrange the post it notes so the ideas with the most upvotes are on top, and the idea’s with the most downvotes are on the bottom!

You now have a clear and glanceable look at what is working and what is not with regard to your original vision for the company.

Step 4 - Repeat For Each Section:

Repeat this process for the remaining boards. Letting every team member contribute ideas and then helping to vote them up/down.

Current Company Narratives

What does the website say right now? If you asked someone else to describe your company back to you, what would they say? Write down an honest depiction of the current narrative.

Goals For New The Narrative

What do you want to achieve, given this new narrative? Hiring more employees? Signing up more customers? Getting more revenue? Getting more funding? A better brand? Whatever it is, write out all the goals.

New Potential Narratives

Brainstorm as many new potential narratives as you can think of. At this point there are still no wrong answers, so don’t filter yourself. Let the ideas flow and allow the dot voting take care of bringing the strong ideas to the top.

Target Customers

Who are going to be your initial target customers? Get as specific as possible. E.g. Startup founders running companies from Seed to Series A.

With the completion of each board, you will see a pattern start to emerge. Granting you a more focused and evolving clarity into how you need to structure your communications going forward.

Step 5 - Forcing Focus:

Remember those frameworks we introduced above. We are now going to apply them as filters to the narratives we just defined.

Sharing two more slides from Founder Institute Co-founder Jonathan Greechan’s presentation around focus for startups:

Put another sheet of the sticky wall easel pad on the wall and add the following to it, with room to write in answers under each:

One Problem

One Customer

One Product

One Killer Feature

One Revenue Stream

This template may seem obvious at first but as any founder can attest; the large magnitude of possible product features you can build, conflicting feedback, and more can sometimes feel burdensome. No body wants a bloated startup pitch. This structure is going to help you focus in on your specific startup’s niche.

Step 6 - The Story of Stories:

In Step 5 you defined your Focus, and now in Step 6, make sure your focus fits all of the criteria of being a killer company narrative.

This is where we come back to the Story of Stories. In the post Tim defines few necessary characteristics of a viable story virus:

Simplicity. The story has to be easily teachable and easily understandable.

Unfalsifiability. The story can’t be easy to disprove.

Conviction. For a story to take hold, its hosts can’t be wondering or hypothesizing or vaguely believing—the story needs to be specific and to posit itself as the absolute truth.

Contagiousness. Next, the story needs to spread. To be spreadable, a story needs to be contagious—something people feel deeply compelled to share and that applies equally to many people.

The story, once believed, needs to be able to drive the behavior of its host. So it should include:

Incentives. Promises of treats for behaving the right way, promises of electroshocks for behaving the wrong way.

Accountability. The claim that your behavior will be known by the arbiter of the incentives—even, in some cases, where no one is around to see it.

Comprehensiveness. The story can dictate what’s true and false, virtuous and immoral, valuable and worthless, important and irrelevant, covering the full spectrum of human belief.

Some great examples of strong story virus include Santa Claus and Catholicism. It is important you have an understanding around these characteristics as we are going to apply them as filters in the next step.

I recommend writing these characteristics down on another sticky wall easel pad so everyone in the room can clearly see the criteria that needs to be met.

Step 7 - Fill In The Blanks:

So we know have all of the following information at our disposal:

Original Company Vision

A understanding of what our company set out to do in the first place.

Current Narratives

What is currently working and not working.

Goals For New The Narrative

How we want to improve the company’s narrative pitch.

New Potential Narratives

The best candidates for our startups’ new story.

Target Customers

Defined segment of target customers.

Knowledge around what makes a good story in the first place

A solid template to force focus.

The next step is to fill in the blanks on the Problem, Customer , Product, Killer Feature, Revenue Stream template board.

The key here is to keep your answers for each to only a few carefully chosen words and to ONLY fill in the blanks with words that meet all of the requirements of the story virus.

String each of the answers together to form one sentence! Just like that Stripe example above.

Securely collecting credit and debit card payments is hard (PROBLEM) for developers (CUSTOMER). With the Stripe Checkout Product (PRODUCT), developers can embed a payment form (KILLER FEATURE) that costs $0.30 per transaction (REVENUE MODEL).

You now have your company’s new narrative!

Step 8 - Go Spread The Gospel

Start pitching your new startup story and see if it is resonating better than before. This process can help immensely when your company is fundraising. If you are like any of the companies I have seen use this process so far, then you should immediately start to see the benefits from this one day team exercise. Remember:

“Genius is the ability to put into effect what is on your mind.”

- F. Scott Fitzgerald

Other Founder Guides you might find helpful:

More on Tim Urban:

You may know Tim Urban from his famous TED Talk “Inside the mind of a master procrastinator”. On his website, Wait But Why, his articles tend to break down complex topics such as Artificial Intelligence, Elon Musk’s Neuralink, Religion, E-mail, Marriage, and so much more, to very simple explanations. So when Tim didn’t publish anything new for 3 years, many readers wondered what he was possibly working on. The answer was a new series of posts titled “The Story of Us”. If you have read and loved Sapiens by Yuval Noah Harari, then I recommend you check out The Story of Us: Full Series!

The Venture Capital Fundraising Landscape

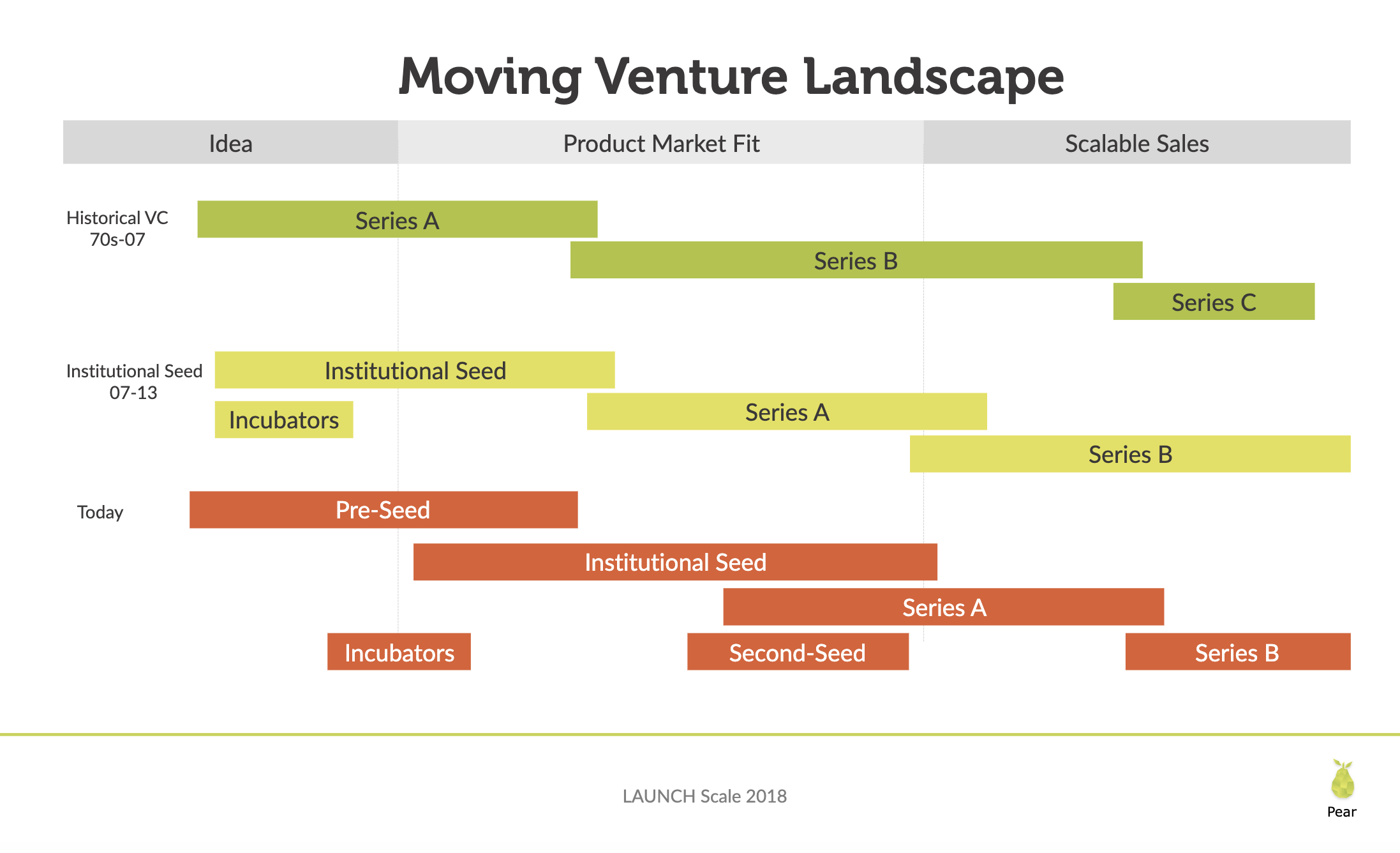

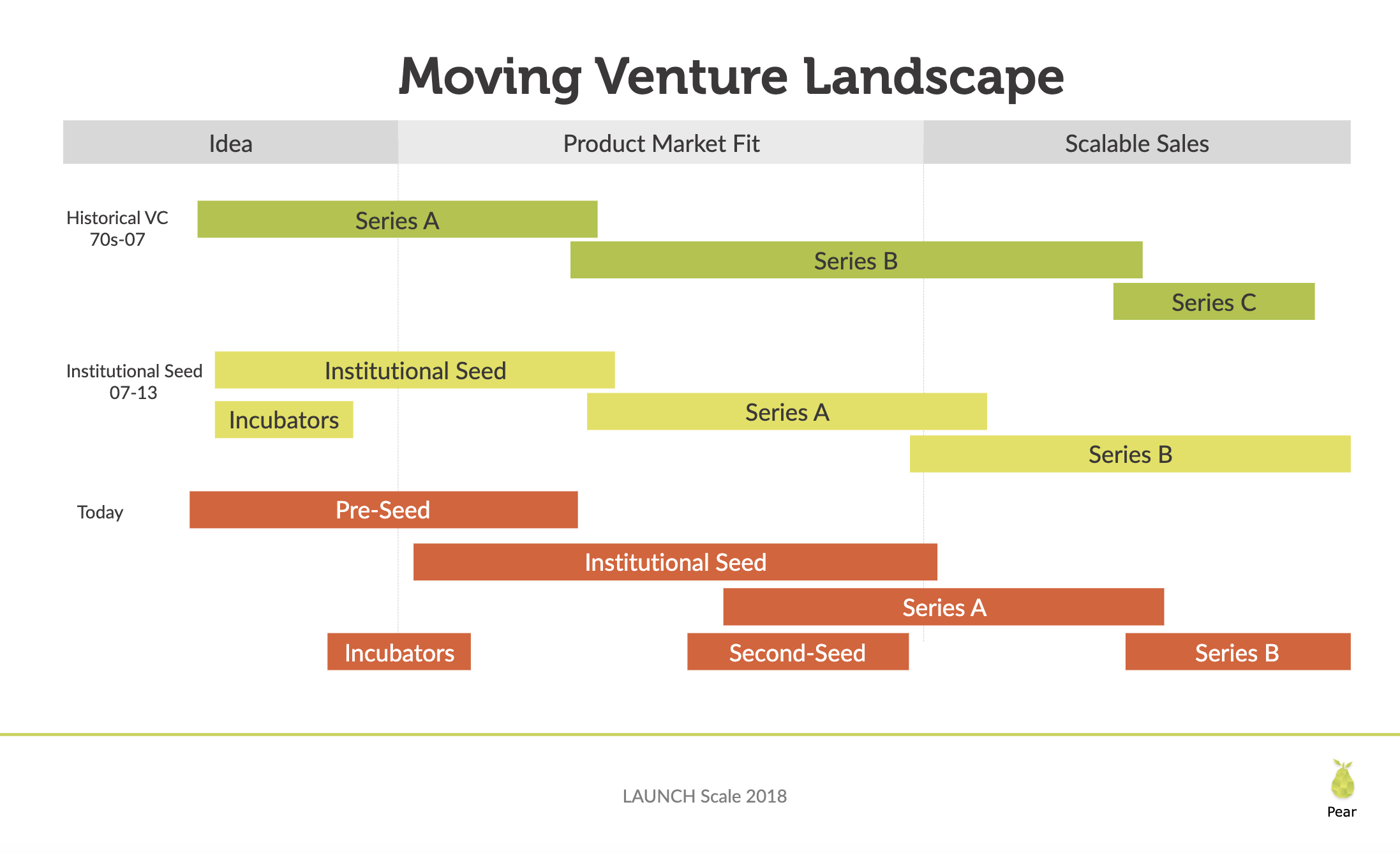

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

2016 Startup Funding Trends With Adeo Ressi

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Adeo Ressi at Valley in Berlin 2016

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Alex Konrad recently gave us some insight on Ambition Today and now today we have a more in-depth explanation of what is happening from Adeo Ressi, the founder of the Founder Institute. Last month Adeo was in Germany for the "Valley in Berlin Summit" and keynoted a talk around the 2016 Startup Funding Trends we are currently seeing. If you are thinking about fundraising, have a startup, or plan on starting your own company you are going to want to watch the keynote below.