How To File 83(b) Election With The IRS

I will keep it short on why you might want to file a 83(b) Election with the IRS and focus more on how to file it, since that is likely why you are reading this. This article from Cooley Law does a pretty good job explaining in much greater detail why making an 83(b) Election with the IRS can be beneficial, as well as this explanation from Wealthfront. Now on to the how to file your 83(b) election instructions.

In the last five years I have helped almost 150 founders through the incorporation process. Time and time again I keep seeing one step of that process, create mass confusion for founders and early employees. Filing the 83(b) Election with the IRS within 30 days of receiving a stock grant or stock options.

I will keep it short on why you might want to file a 83(b) Election with the IRS and focus more on how to file it, since that is likely why you are reading this. This article from Cooley Law does a pretty good job explaining in much greater detail why making an 83(b) Election with the IRS can be beneficial, as well as this explanation from Wealthfront.

In short, an 83(b) election means you will be taxed on the value of your stock at the time of the grant, rather than as it vests. For founders & early employee’s of new company’s, whose stock is usually priced at $0.0001 per share at incorporation, it can make a lot of logical sense to pay upfront tax while the price of the company is still very low. Now on to the how to file your 83(b) election instructions.

IMPORTANT 83(b) Election Deadline: You must file your 83(b) Election with the IRS within 30 days of receiving your stock grant or stock options! The filing is officially deemed to have been made on the date the 83(b) is mailed from the post office; i.e. the postmark date.

If your stock is not subject to vesting, then you can ignore this process and move on with your day. 83(b) Elections are not required for those without a vesting schedule.

Steps To File Your 83(b) Election

Start with gathering the required 83(b) form documents:

If your lawyer has provided you with 83(b) election forms you may use those. If not, then print four copies of page 9 from the 83(b) Election IRS form here.

You also need to include a cover letter to the IRS, a template of which can be found here: IRS Cover Letter Template.

Complete and review all four copies of the 83(b) election form, review, date, manually sign and insert the taxpayer identification number for the taxpayer (and spouse, if applicable).

Look up where to send the completed forms by finding your state on the "Where to File Paper Tax Returns With or Without a Payment” page of the IRS website.

Enclose the following in an envelope to be mailed:

Two copies of your completed 83(b) election.

Completed cover letter.

A return self addressed envelope with stamps. The IRS will keep the first copy of your election and stamp the second copy. The self addressed envelope will be used to mail back to you the second stamped copy of your election, so you can keep it on file in your records.

Mail the enclosed envelope with 2 completed copies of your 83(b) election & cover letter to the IRS via USPS certified mail and request a return receipt.

Send another completed 83(b) election to your company.

Keep another completed 83(b) election for your personal records.

Thats it! Be on the lookout in the mail to receive that second stamped copy back from the IRS. And as always, be sure to keep your records someplace safe like a fireproof lock box.

Other Founder Guides you might find helpful:

Disclaimer: I offer this post only as helpful guidance as I am not a lawyer or certified accountant. You should still research on your own and consult your accountant or lawyer if you are uncertain of the process.

LIVE EVENT! Cryptocurrency, ICO, & Blockchain Law in 2018 with Joe Daniels of McCarter & English

This episode comes to you from the heart of New York City for our first live podcast episode discussing cryptocurrency, ICO, & blockchain law!

Joe Daniels, Co-Chair of McCarter & English Venture Capital & Emerging Growth Companies practice

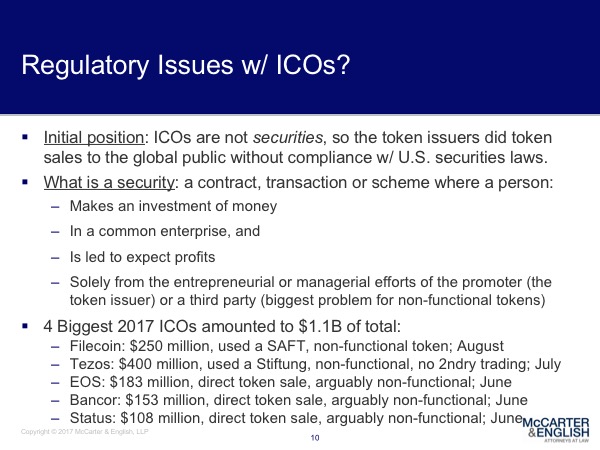

This episode comes to you from the heart of New York City for our first live podcast episode discussing cryptocurrency, ICO, & blockchain law. In late January almost 100 founders gathered at the offices of McCarter & English for our January Founder Institute Meetup! The crypto founders there heard from Joe Daniels, who is the Co-Chair of the McCarter & English's Venture Capital & Emerging Growth Companies practice. Joe has worked on numerous SAFT & token offerings, including San Francisco based Quantstamp, which just raised $30 million in its pre-sale, along with Augmate, The Valorem Foundation, RealECoin, VIMarkets, CoinBoost, and RecylcleGO.

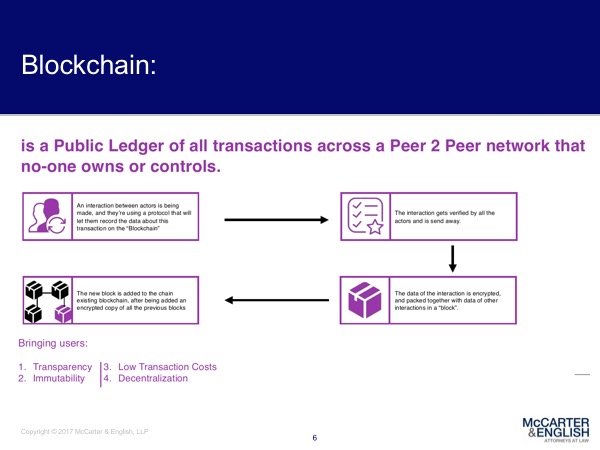

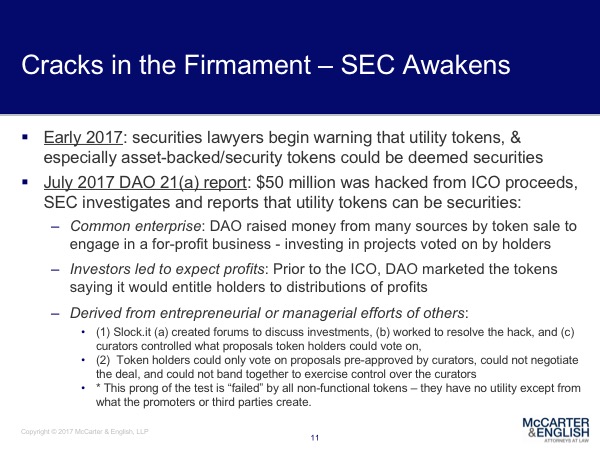

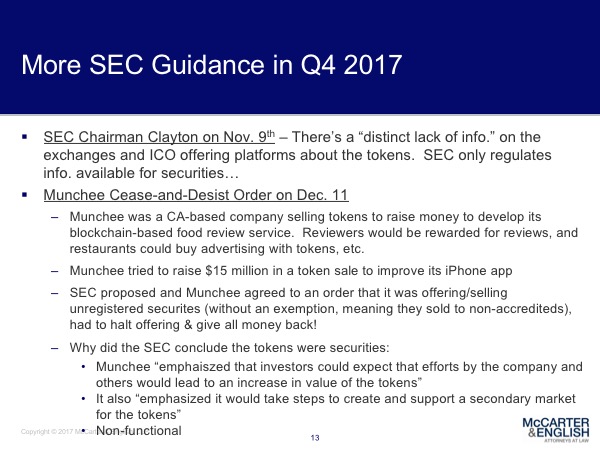

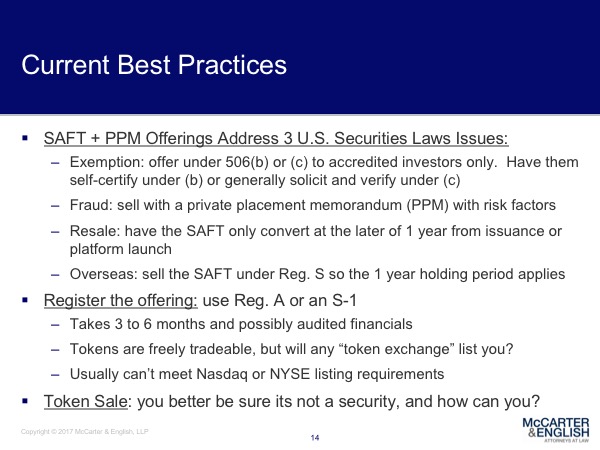

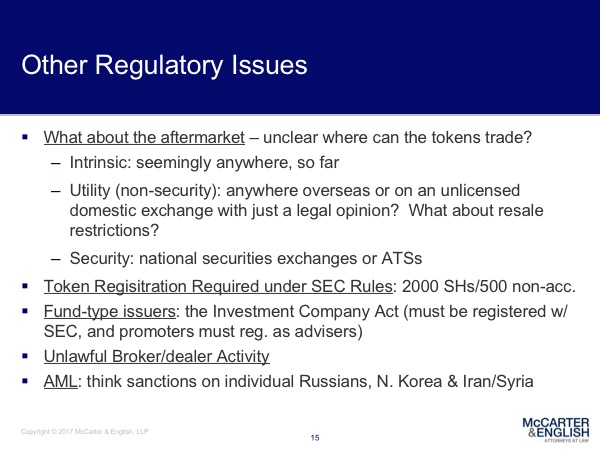

During this event, Joe reviewed the current cryptocurrency, blockchain, & initial coin offering laws in 2018. Learn the key things that you need to know about ICO's, the SEC, international business, SAFT agreements, and more. If you are interested in understanding the legalities around cryptocurrencies, tokens, and the blockchain, then you will definitely enjoy this episode. The slides that Joe is going over during his presentation are available below if you want to follow along. They are packed with information, such as:

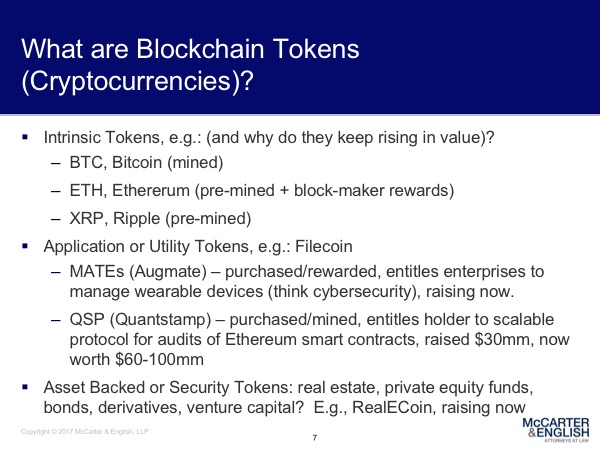

What are Blockchain Tokens (Cryptocurrencies)

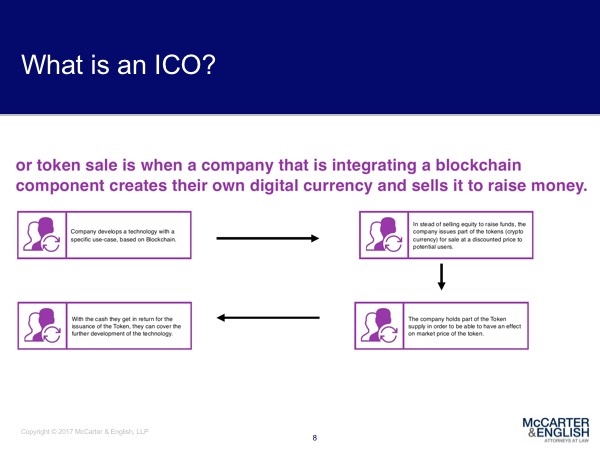

What is an ICO

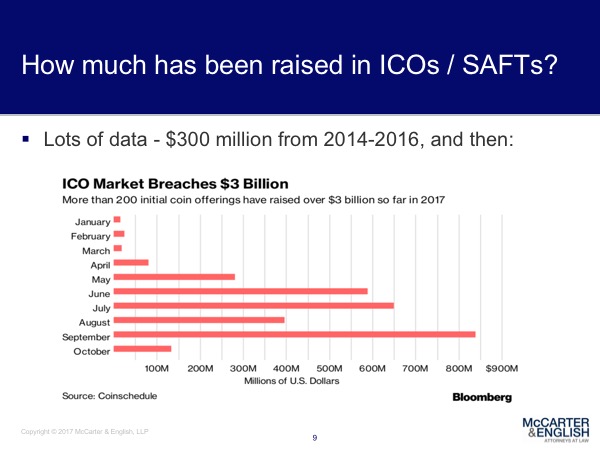

How much has been raised in ICOs / SAFTs

How do SAFT agreements work

Regulatory Issues w/ ICOs

The SEC's response to the emergence of cryptocurrencies

Current Best Practices for cryptocurrencies

Follow Along With All The Slides From The Event:

Listen to this episode now:

Join the shows A-list backchannel for exclusive access to additional Ambition Today content, deeper guest insights, a community of fellow fans, and much more. Plus, Learn the single greatest piece of advice this guest has ever learned!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

You can find the full transcript of this episode here.

Be sure to listen and subscribe to the show on your favorite podcast platform.