Finta is on Product Hunt Today!

Finta is on Product Hunt today! 🥳 We are constantly improving the product with your feedback. So very grateful to the Product Hunt community today and massively appreciate any upvotes! 😻

Finta is on Product Hunt today! 🥳 We are constantly improving the product with your feedback. So very grateful to the Product Hunt community today and massively appreciate any upvotes! 😻

We have been building Finta to be your one fundraising app to replace them all - giving users all the tools they need to streamline the fundraising process end to end so that founders can focus on building real investor relationships. We’ve been working on building and growing Finta over the last year and we’ve had a fantastic response from our users so far. We’re proud to say that we’ve helped founders raise millions of dollars!

In addition to our (actually useful) free-forever plan features, we’re giving a FREE MONTH OF PREMIUM FEATURES for our Product Hunt launch! We now have:

✅ Secure deal rooms that can be shared with a single link.

✅ Deal rooms allow you to attach and include due diligence docs in a single place.

✅ Automated CRM that moves contacts through the funnel automatically as they use your deal room.

✅ Automatic scriptwriting for your email outreach.

✅ Investor database that you can get matched with the best quality investors for your company.

… and a lot more!

Would love to know your thoughts and any feedback, as we are constantly improving Finta and your feedback will have a big impact :) Thank you so much!

Product Hunt is a curation of the best new products, every day. Letting you discover the latest mobile apps, websites, and technology products that everyone's talking about. Thank you again for your constant support!.

How Lorenzo Thione Is Scaling Support For Diverse Founders With Gaingels

Lorenzo Thione is the Managing Director of Gaingels, a leading LGBTQIA+/Allies investment syndicate and one of the largest and most active private investors in North America. He is also the co-founding Chairman of StartOut, Chairman of the Board at Social Edge, and previously co-founded Powerset, a natural-language search engine startup sold to Microsoft for $100 million in 2008.

We sat down with one of the most influential people in tech, Lorenzo Thione, who shares his very inspiring journey and how that led him to be where he is today.

Lorenzo grew up in Milan, Italy and had a technical background at an early age. He completed his studies at the University of Texas at Austin, from which he holds a M.S. in Computer Engineering.

He is now the Managing Director of Gaingels, a leading LGBTQIA+/Allies investment syndicate and one of the largest and most active private investors in North America. He is also the co-founding Chairman of StartOut, Chairman of the Board at Social Edge, and previously co-founded Powerset, a natural-language search engine startup sold to Microsoft for $100 million in 2008.

Lorenzo is named one of the most influential LGBT people in tech in 2014 and 2018 and his dedication in supporting and elevating leaders of the LGBTQ+ in the venture startup is amazing.

As the Managing Producer at Sing Out, Louis! Productions, he is also a Tony-Award winner (Hadestown, The Inheritance). He produced and co-created the Broadway musical, Allegiance starring George Takei and Lea Salonga. He is currently working in a new original musical, Indigo, as well as The Elephant Whisperer.

We covered a lot of ground in this episode, including:

Topics Discussed:

Where his passion comes from and how Lorenzo found entrepreneurship.

Helping others to build a diverse company by providing more than just funding.

The different companies that he had a part in building.

His mark on Broadway.

How your descent can make a difference in your future and your thinking.

How the model of angel groups is evolving to syndicates and SPV’s.

The role of a “Platform” strategy to help Gaingels portfolio companies.

What does Lorenzo think about the future of Venture Capital.

Quote of the Episode:

“Strategic Value, what is all being brought to the table”

The Greatest Piece of Advice:

His mentor told him to, “ be obsessive, about how you can add value, to your own network and relationships”

Links & show notes from this episode:

Ambition Today Is Proudly Independent & Supported By:

Finta - Finta’s end to end fundraising management platform enables you to manage your investors throughout their entire lifecycle in a single streamlined flow.

A-List: After every episode of the Ambition Today podcast we record an exclusive bonus clip, where we ask each guest to tell us the best advice they have ever received. Hear first-hand stories from over 30 entrepreneurs and investors in these exclusive bonus clips.

Listen to Ambition Today now:

Thank you for listening!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going! 🤗

43North's $1 Million Investment Opportunity

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

Being born and raised in Buffalo, NY, I have always loved my hometown city. If you are curious about why, I recommend you check out “The Incredible History of Buffalo, NY In 5 Minutes”, which I shared in the Huffington Post a few years ago.

Scott Wayman of Kangarootime, after winning 43North in 2017

In 2014, Buffalo started 43North, investing $5M per year to attract and retain high-growth companies in Buffalo, NY. Fast forward to 2017, and after meeting Scott Wayman, the founder of Kangarootime, at a Founder Institute event in Silicon Valley, I recommended the company to 43North. Kangarootime ran with it and crushed it. First, securing an initial $500k investment from 43North, and then subsequently more follow on funding. They have since grown a significant presence in Western New York and continuing to build a great company!

Then in 2018, one of my Founder Institute New York portfolio companies, Teddy Mozart, received a large purchase order from QVC. A massive break, but they needed help financing the inventory to fill the QVC order. Carlton, the founder, told me he found Kickfurther, which secures inventory funding via their marketplace of investors. Through Kickfurther, Teddy Mozart managed to get the funds needed to fill the QVC order in less than 72 hours! I told this story while helping to deliberate the final investment decision in 2018, and I like to think it helped play a role in Kickfurther joining the 43N portfolio that year!

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

If you or someone you know might be a good fit, visit 43 North to apply, or feel free to text me at +1 (646) 907-6669 if you would like to connect directly about the opportunity!

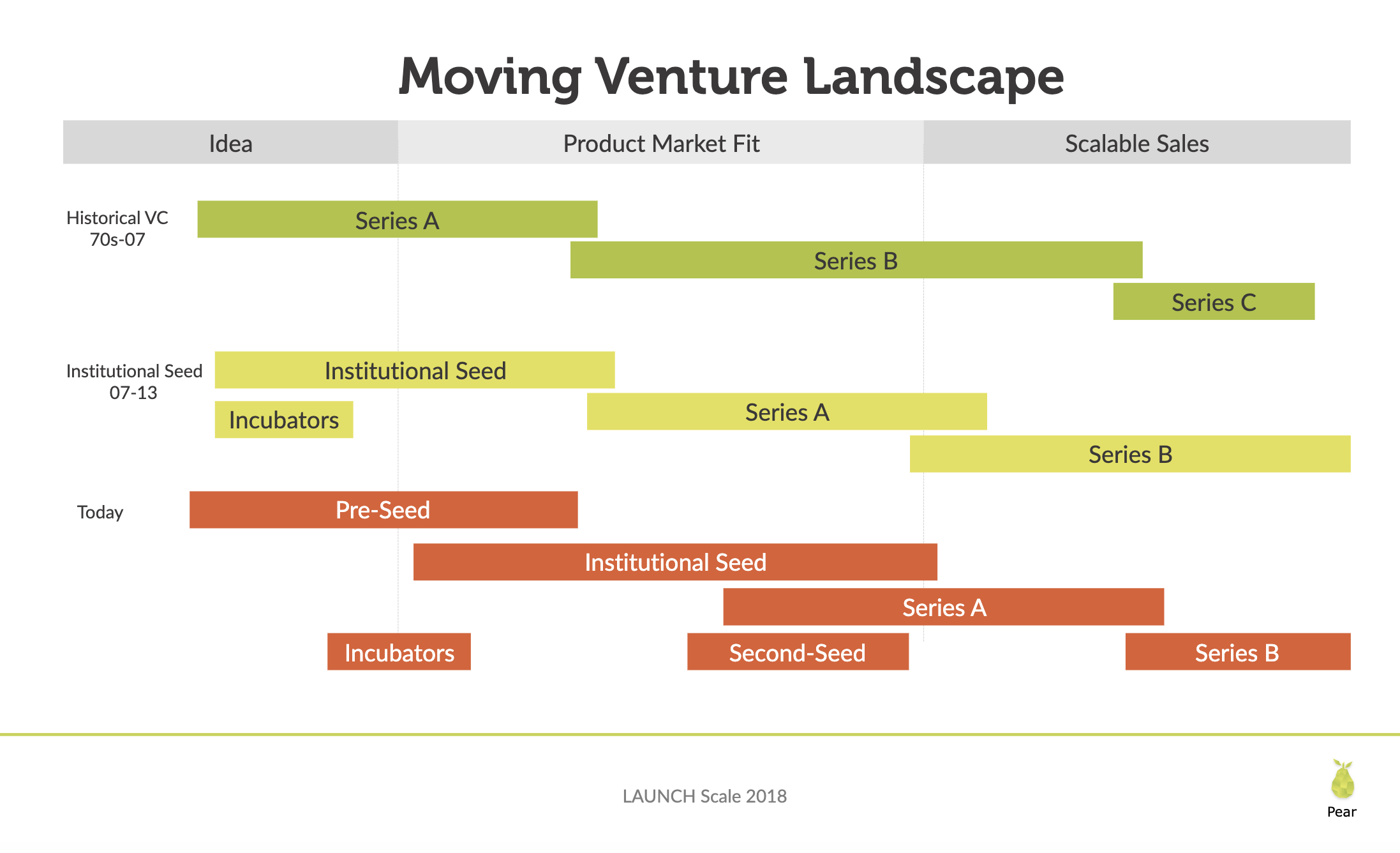

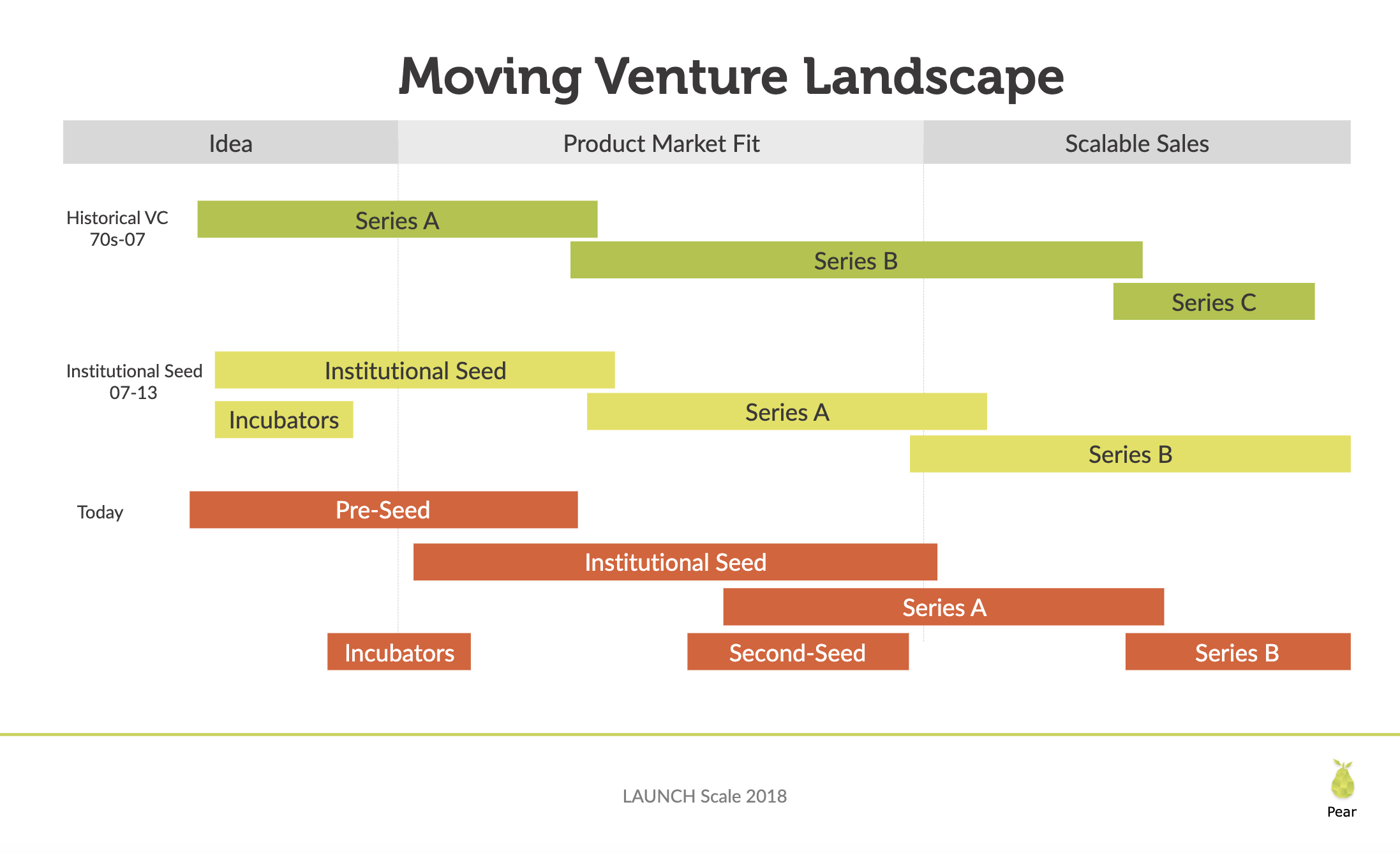

The Venture Capital Fundraising Landscape

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

Terry Young's Sparks & Honey Is Mapping Culture To Forecast The Future

From a small town in Western Kentucky to becoming an entrepreneur on Madison Ave, Terry Young joins us on this episode of Ambition Today. Terry is a successful advertising entrepreneur and the CEO of Sparks & Honey

Terry Young, CEO of Sparks & Honey

From a small town in Western Kentucky to becoming an entrepreneur on Madison Ave, Terry Young joins us on this episode of Ambition Today. Terry is a successful advertising entrepreneur and the CEO of Sparks & Honey, a company identifying and mapping emerging cultural waves through the use of machine learning systems, algorithms, and human insight.

After earning his Master’s Degree in advertising, Terry started working in the digital advertising industry in 1995, when digital marketing was just getting started. A short two years later, he was running the company. Terry got the opportunity to live in China and help start-up initiatives while working for McKinsey. He also lived in Kazakhstan while in the Peace Corp where he helped small business shops with their financing and starting their businesses. Terry brings a great perspective on culture and new trends. On this episode, we also discuss:

Growing up in a small town in Kentucky

The impact of joining the Peace Corp

Rebuilding the traditional advertising model

The intersection of being gay and an entrepreneur.

How Sparks & Honey maps culture

Why predicting the future matters

Defining micro signals and macro trends

What is happening in the space industry

Ambition Today Question of the Day™ :

“How do you best recommend that people in organizations ride the waves in a trend?”

The Single Greatest Piece of Advice Terry Has Ever Learned:

Join the Ambition Today A-list to listen now!

Quote Of The Episode:

“I say to every person who was here … that has left, you are also leaving your shape and your mold on the company, because it is a reflection on them too.”

Links from this episode:

Listen to this episode now:

Join the shows A-list backchannel for exclusive access to additional Ambition Today content, deeper guest insights, a community of fellow fans, and much more. Plus, Learn the single greatest piece of advice this guest has ever learned!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

You can find the full transcript of this episode here.

Be sure to listen and subscribe to the show on your favorite podcast platform.

Anthony Pompliano Is Going Full Tilt To Invest In World-Class Blockchain And Crypto Asset Ventures

Anthony Pompliano is the Managing Partner at Full Tilt Capital, an early stage venture capital firm. Full Tilt Capital now focuses exclusively on investing in world-class companies in the blockchain and crypto asset space.

Anthony Pompliano, Managing Partner at Full Tilt Capital

Anthony Pompliano is the Managing Partner at Full Tilt Capital, an early stage venture capital firm. Full Tilt Capital focuses exclusively on investing in world-class companies in the blockchain and crypto asset space.

"Pomp" was raised in Raleigh, NC, and is one of the first south easterners that we have had on the Ambition Today podcast. He is the oldest brother of five and during his junior year of college, he was deployed to Iraq. During his deployment, he gained a unique perspective on life. His world traveling allowed him to learn about new cultures all around the world in order study human behavior. Once he returned from duty, he jumped into the world of Silicon Valley. He built two small technology businesses and worked for large tech companies like Facebook and Snapchat before starting Full Tilt Capital. Anthony brings us his knowledge, unique insight, and more on this episode of Ambition Today:

- Life lessons from being deployed to Iraq

- Building and selling his first technology business

- What it was like working for Facebook

- Full Tilt Capital's investment thesis

- How important a founders self-honesty is

- Why GPU will beat CPU's in the future

- The story of Standard American Mining

- Why Full Tilt is going all in on blockchain companies and crypto assets

- How to build a successful Angel List Syndicate

Ambition Today Question of the Day™ :

"How do you think about and manage your personal brand, and also find time to get your day to day operations work done and build Full Tilt?

The Single Greatest Piece of Advice Anthony Has Ever Learned:

Join the Ambition Today A-list to listen now!

Quote Of The Episode:

"You don't have to be honest with me. I want you to be, but you don't have to be. You have to be honest with yourself."

Links from this episode:

Listen to this episode now:

Join the shows A-list backchannel for exclusive access to additional Ambition Today content, deeper guest insights, a community of fellow fans, and much more. Plus, Learn the single greatest piece of advice this guest has ever learned!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

You can find the full transcript of this episode here.

Be sure to listen and subscribe to the show on your favorite podcast platform.

What Is Blockchain? What You Need To Know About Bitcoin, Ethereum, NFT’s, And Crypto

With Coinbase officially adding over 100,000 new accounts per day, I have started to get a lot more questions about Cryptocurrency and Bitcoin in general. My goal with this post is to provide people with a starting point to best get up to speed on the space, fast!

Old coins from the Roman Empire

It is a long journey down the rabbit hole of Cryptocurrency to truly understand everything that is going on within the blockchain space (and how it is affecting other industries). But it is not an impossible task, and you have to start somewhere. With Coinbase officially adding over 100,000 new accounts per day, I have started to get a lot more questions about Cryptocurrency and Bitcoin in general. My goal with this post is to provide people with a starting point to best get up to speed on the space, fast!

I first heard about Bitcoin in 2012 while writing daily Tech news for the Launch Ticker. I believe it was priced around $10, but I didn’t understand Bitcoin at the time, so I didn’t buy any. Then, in 2013, Bitcoin became what I would refer to as "Silicon Valley / Venture Capital" mainstream. Which in hindsight, I think we in the industry sometimes forget just how early to new ideas and industries we can be. Even still I did not buy any bitcoin. Even with everyone talking about something, it can be so easy to dismiss the things we don’t understand. And so, as Wayne Gretzky once famously said, "You miss 100% of the shots you don't take."

So two years later I took a deeper look at Bitcoin and I started to understand how it all works before buying some. I went down the rabbit hole; reading blog posts, sub-reddits, listening to podcasts, de-mystifying the blockchain, smart contracts, etc.

Which brings us to today. If 2016 and 2017 have taught us anything, it is that we are in a new era where awareness outpaces execution. In my opinion, social media and the connectivity of smartphones has no problem getting people talking about the hot topics of the day or week on the surface. But we are flooded with so much information that it has become harder to filter what is worth stopping, taking the time to learn more, and going deep on a subject.

And so today, my advice is to take some time to understand Cryptocurrency and it's surrounding technologies. Whether or not you are a believer in Bitcoin, Ethereum, or any other cryptocurrency, the technologies that have enabled this revolution, such as the blockchain, are almost certainly here to stay. I am going to lay out some information, which should help you gain a deeper understanding around the whole industry. I would recommend digesting them in the order I present them in, and remember to keep an open philosophical mind:

Understand Why We Have Money and How It Works Today:

Yuval Noah Harari, Author of the book Sapiens, explains how civilization came to have money over the course of evolution in this TED talk: "Why Humans Run The World". I recommend watching it all, but skip to 10:45 in the video if you want to fast forward to the money part.

This video on Money and Finance from John Green's youtube channel Crash Course is a super quick refresher on how our modern day monetary systems work. It even briefly mentions how Bitcoin has played a role as it has emerged over the past few years.

Bitcoin:

Banking on Bitcoin is a 2017 documentary currently on Netflix. The first 20 minutes will give you a great overview on how Bitcoin ad the technology around it works. With the rest of the film covering the history of cryptocurrency, regulation of the industry, who is Satoshi Nakamoto, the dark web, and how people have used Bitcoin to date. It features interviews with enthusiasts and experts, this documentary covers Bitcoin's roots, its future and the technology that makes it tick.

Blockchain:

The Blockchain is actually explained somewhat simply during this TED talk by Lorne Lantz.

In this episode of the Tim Ferris Show "The Quiet Master of Cryptocurrency", he is joined by Naval Ravikant (who you will also see in Ethereum TechCrunch talk below with Vitalik Buterin) and Nick Szabo (who you might remember from the Banking On Bitcoin documentary above).

This episode goes much deeper into the world of cryptocurrency. You will learn about how the blockchain works, the history of smart contracts, what a Merkle Tree is, the importance of decentralization, and so much more!

In this video from Wired, Blockchain researcher Bettina Warburg explains the blockchain in every age from a child up through graduate school. It then ends with a great conversation with another Blockchain expert.

Lastly with regard to the blockchain, if you click the button below you can see a step by step visual demo of the blockchain in action. I highly recommend clicking through the demo to better understand how blockchains work.

Ethereum:

At age 19, Vitalik Buterin, created Ethereum in 2013. To think about it simply, Ethereum is similiar to Bitcoin but it also allows developers to deploy code and software programs on it's blockchain.

Ethereum is a decentralized platform that runs smart contracts; applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference. These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property.

Buying Bitcoin and Cryptocurrencies:

The easiest way to get started with cryptocurrencies is by creating an account on Coinbase.

After signing up you will be provided with your own digital wallet, which is stored in the cloud, on Coinbase’s servers. This is important to note because you are trusting a third party to protect your wallet. There are other digital wallet alternatives if you would prefer to not store your cryptocurrency on Coinbase, such as storing your wallet on your computers hard drive or on an external Zip drive. Whichever you choose, be sure to pick a wallet that is secure. Using Coinbase you can buy Bitcoin, Ethereum and Litecoin.

Important Note: Be sure to ALWAYS use two factor authentication. Do not use SMS based two step verification as your phone number can be stolen depending on your phone company. To understand why this is important and learn some more security tips to secure your digital wallet, I recommend reading Cody Brown's article "How to lose $8k worth of bitcoin in 15 minutes with Verizon and Coinbase.com".

If you are looking to get involved with more Crypto Assets & Currencies I am linking to some getting started guides below:

A Beginners Guide To:

Bitcoin Cash

Ethereum

Ethereum Tokens

Monero

Litecoin

0x

Tezos

Decred

Zcash

For more cryptocurrencies you can check out Coin Market Cap to see what else is out there. Clicking on a currency on Coin Market Cap will show you more information about it, including historical prices, as well as tell you the available exchanges you can buy from.

ICO's:

Be wary of Initial Coin Offerings of new tokens. Many new coins that are being created are simply not needed in my opinion. Especially if the same function or utility could be done using an already existing cryptocurrency.

If you do find a crypto currency you like, then you need to evaluate the whole project, just like you would if you were investing in an early stage startup. Make sure you research the amount of money being raised, what the token does, the valuation that the project actually works and is live, the team behind it, etc. Just how with early stage startups, only the top 5% of companies are worth investing in, the same is true of ICO’s. Most ICO's will likely fail. Fred Wilson, has a good blog post on how to carefully evaluate these new crypto assets.

White Papers:

White papers lay out the foundation for how a crypto asset works and what principles it relies upon. In the world of crypto, they are similar to the pitch decks that startups put together today or a traditional business plan, and they are typically shared with the public. To really get a good understanding of what they look like, I am including the original Bitcoin white paper wrote by Satoshi Nakamoto and the Ethereum white paper.

Hard Forks:

Forks happen when a blockchain splits in two, going forward from a certain date. The main cause of a hard fork is because of a new rule that gets created by a certain portion of the community. This can create another currency if the new network is stable enough to sustain itself after the fork. Being as both the old and the new currencies share the same ledger history, customers with balances of the original currency at the time of the fork now have an equal quantity of the new currency. You can read more about forks here and the few most successful forks to date are:

Bitcoin Cash - Forked from Bitcoin on August 1st, 2017.

Bitcoin Gold - Forked from Bitcoin on October 25th, 2017.

Ethereum Classic - Forked from Ethereum in 2016.

Regulation And Sustainability:

Being as regulation can be quite complex, I am going to simply link out to some additional reading materials in this section.

State Regulations:

China

Singapore

South Korea

Historical Incidents:

Mt. Gox: In 2014, 850,000 bitcoins, worth $450 million at the time, had disappeared or been stolen by hackers.

DOA: In June 2016 an anonymous hacker exploited a critical flaw and stole $31 million in Ether in a few minutes.

Energy Consumption:

High Energy Consumption:

Low Energy Consumption:

Wall Street

J.P. Morgan

Futures Contracts

The Future of Cryptocurrency:

I encourage you to clickthrough and view all of the slides Chris Burniske, Author of Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond, has put together. I have shared the first slide and my favorite slide below:

DISCLAIMER: These are just my personal thoughts and resources. I hope it helps you learn about the cryptocurrency industry so you can better make your own decisions. Be sure to do your own thorough diligence before making any financial decisions. Always invest responsibly.

How Adeo Ressi Empowered 2,700+ People To Become Startup Founders

Over the summer we sat down with Adeo Ressi, the CEO of the Founder Institute, a startup accelerator program that operates in nearly 200 cities worldwide.

Adeo Ressi

Over the summer we sat down with Adeo Ressi, the CEO of the Founder Institute, a startup accelerator program that operates in nearly 200 cities worldwide. Throughout his time as a founder, Adeo has pioneered innovations in the protection of founder rights, the raising of early-stage capital and the scaling of new businesses.

Previous to the Founder Institute, Adeo has helped to create nearly $2 billion in shareholder value by founding or running nine businesses, including TheFunded, Game Trust, Xceed and Total New York. Adeo previously served on the Board of the X Prize Foundation to pursue his interests in space exploration and techniques to motivate human achievement. Throughout this episode it is clear that Adeo is passionate about mentoring Founders, space exploration, inspiring people to achieve their greatness, and more which includes:

The personality traits of the best founders

How The Funded improved transparency in the VC industry

The role fluid intelligence plays in entrepreneurs

How Adeo helped 2,700 plus founders grow through the Founder Institute

Managing your investors and protecting your equity

How to build startup ecosystems

Why maintaining focus and avoiding distractions is mission critical

How do you give meaning to your life's work

Ambition Today Question of the Day™:

"What is the end game? Where do you see Founder Institute and all your life’s work going?"

Quote Of The Episode:

"There are a lot of shiny things in the sand, that look very appealing to you and may be a cause for you to think about pivoting or adjusting the business model. I can tell you that most of the shiny things in the sand are not diamonds, they are knives waiting to kill you. You have to be very, very, very diligent to remain focused on your core mission"

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

You can find the full transcript of this episode here.

Be sure to listen and subscribe to the show on your favorite podcast platform.

Listen to this episode now:

Join the shows A-list backchannel for exclusive access to additional Ambition Today content, deeper guest insights, a community of fellow fans, and much more. Plus, learn the single greatest piece of advice this guest has ever learned!

How To Send Your Monthly Investor Updates

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master.

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master. Sending monthly investor updates is one of the best ways for a founder to maintain their existing connections and strengthen their new ones.

Long-term relationships are built with friends, family, and colleagues by staying close and in touch over long periods of time. It is so important that you still keep in contact with the people you want to stay close too, even when you think you don't have value to add or need something in the exact moment. One of Founder Institute New York’s mentors, Matt Rodak talked about the importance of sending monthly updates while building his startup company, Fund That Flip on an Ambition Today episode recently.

Benefits of Sending Investor Updates Frequently:

While this may seem overly simple at first glance, I assure you that many people take basic communication for granted and avoid the little bit of work it involves each month. For those that do send monthly updates, there are several non-obvious benefits aside from your company's business updates.

Being Top Of Mind:

Even if you don't get a response, it keeps you on top of people's mind. That next meeting your investor has, they might bring you up while you are fresh on their mind.

Creating Stronger Relationships:

Mark Suster has famously been quoted as saying people "Invest in Lines, Not Dots". Keeping in touch is how you build a long-term and enduring relationship. It's been that way since the caveman days and hasn't changed. It's human psychology.

Assuring Company & Personal Health:

Most of the time that investors don't hear from a founder they assume their startup company is dead or well on its way. Or worse, they just forget about you entirely. You just fade away from their memories, replaced by fresher memories of other startup founders. Before the internet, this was a given. In the world of social media though, we take this for granted as many feel that "online presence" is enough. I assure you, that unless you are Mark Cuban, it is not.

Gaining Insights & Reflection:

The process is insightful. Taking a moment to send someone an update on your life or business forces you to take a moment and reflect on the progress you have made in the last 30 days. In our busy lives, it is critical to make that time. As an additional bonus, you will be more productive and make better-informed decisions in the coming month as well.

Formatting:

So what should you include in your startup’s investor updates? You can find plenty of investor update examples and how-to articles that already exist when you google “Monthly Investor Updates." I am going to include links to many of my personal favorites below! There are many different styles of monthly investor updates, but most involve the same essentials.

Dear Kevin,

I hope you had an excellent August! For us it has been a mixed month, but we’re happy to report these developments.

Cash: Money in Bank and Monthly Expenses

Highlights:

KPIs:

Customers Update

Useful Graph, Image, or Screenshot

Employees/Team Changes

The Good:

The Bad:

Asks

Thank You's

Thank you,

Kyle

CEO, ACME Corporation

Monthly Investor Update Templates & Examples:

There are so many great investor update examples and investor update templates from some really amazing investors and founders: I collected some of the best investor update templates below for you:

A “Fill-In-The-Blank” Investor Update Template for Busy Founders - Micah Rosenbloom

13 Investor Update Emails That Turned Our Dots Into A Line - Reza Khadjavi

The Why and How Of Updating Your Angel Investors - Dharmesh Shah

What Should I Include In My Monthly Investment Update? - Jason Calacanis

So at the end of this month take even just one hour to send a monthly update. You should keep your update short and to the point. Think about what you have accomplished in the last month and what you need help achieving in the next month. Think about the people in your life that mentor and guide you. Hopefully, you already have them on a mailing list. And then send your update. You will be AMAZED at the compounding effects you will receive from putting monthly updates out there!

From Israel to Silicon Valley, Niv Dror's Journey To Conquer Social Media

Season Two of Ambition Today is happy to welcome Niv Dror, head of social media for Product Hunt. Niv boasts in impressive resume in both startups and finance, stemming from his education at UC Santa Barbara.

Niv Dror, Shrug Capital

Season Two of Ambition Today is happy to welcome Niv Dror, head of social media for Product Hunt. Niv boasts an impressive resume in both startups and finance, stemming from his education at UC Santa Barbara. After moving to Silicon Valley at a very young age, Niv had surprisingly little involvement in the tech world. It surrounded him entirely and thus he never noticed it, as water to a fish. However, after auditing a few hedge funds and VC funds as a CPA, he knew where his skills truly belonged.

Niv Dror’s taste of the tech community flourished very quickly, landing non-engineering jobs at DataFox, Meerkat, and Product Hunt. He aspired to add value without asking anything in return, and was rewarded with the experience and skills to climb the ranks at multiple organizations, currently aiding the curation of the world's most cutting-edge technology on Product Hunt. Kevin and Niv explore what's behind this drive, the man he gives credit to involuntarily kickstarting his success, and much more:

Growing up in Israel and moving to the U.S. at a young age.

Pursuing a finance degree and applying it to the startup world.

Getting exposure to the tech industry by auditing a successful VC.

Building an engaging community around a product.

What changes we can see in social in 2017.

The war of pronunciation for “gif”.

We why all love gifs and how Twitter is the perfect platform.

Ambition Today Question of the Day™:

"Should people optimize for learning or for earning?"

Quote Of The Episode:

"Community is everything. Without the community, Product Hunt wouldn't work."

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

A Consciously Fresh Perspective

It is time for a consciously fresh perspective. I have always been extremely curious about what is happening in the world around me. In college I mixed that curiosity with scientific analysis when I majored in Cognitive neuroscience...

It is time for a consciously fresh perspective.

I have always been extremely curious about what is happening in the world around me.

In college I mixed that curiosity with scientific analysis when I majored in Cognitive neuroscience, the analytical combination of Neuroscience, Philosophy, Psychology, Linguistics, and Artificial Intelligence. If that wasn’t enough, I then minored in Philosophy as I enjoyed solving deep and challenging logic problems.

Fast forward to today and I work with startups. As a result over the years, I tend to have a habit of early adopting new technology before the majority of people get it. Some of which I have written about before such as Fitbit, Google Glass, Apple Watch, Boosted Boards, and several innovative companies. I do this because I believe there is an advantage while working in Venture Capital to experience and understand new technology first hand in order to be able to accurately see future trends.

Also, I live in New York City, which means that anything I can think of is literally accessible within walking distance of me every day.

Combining all of the above, if I were to describe myself today I would say I am an extremely curious, analytically scientific, deeply philosophical, and optimistically futuristic person. Side-note: I still like having fun too 😉 .

The reason I have been thinking about this and am sharing it with you, is that along with 47.9% of America that went blue I did not see the U.S. election results coming. Brexit and the rise of populism have caught me by surprise as well.

The point of this post is not to dive into political waters though. So putting aside specific political candidates, echo chambers, inaccurate polling, my own personal beliefs, and more; what this post is really about is me reconciling that I failed to empathize with the other 47.2% of red America.

To be clear, empathy doesn’t mean you need to agree with someone. It means you understand another person's experiences and emotions; the ability to share someone else's feelings. I have not done a good enough job of that in recent months. Last week was a sobering reminder for the need to stay constantly aware of the lens that one views the world through.

It is important to keep a clear and honest perspective that balances the past, present, and future at the same time. To force oneself to take a step back and keep a consciously fresh perspective. To grow the personal self awareness to be able to see that at times there are differences between how your own experiences cause you to perceive the world, how other people are perceiving the same situation, and what is really happening.

Lastly, while personally working to view the world through that unbiased lens it is important that we talk to more people. Including those who disagree with our viewpoints. Exposure to the opinions and beliefs of others is the only way to gain a wider and more accurate view of the world.

Jesse Middleton Talks Building WeWork Labs And Investing With Flybridge Capital

Over the years WeWork has grown to become an $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Jesse Middleton

Over the years WeWork has grown to become a $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Early on with entrepreneurial parents, Jesse learned that he did not have to take the traditional path in life and that he could forge his own future. He started to do just that, as he founded his first company before even going to college. Fast forward to Fast Company magazine once comparing Jesse to Jack Dorsey, then onto his time building WeWork Labs, and now his time as a VC at Flybridge. Jesse has a great story full of many lessons, such as:

Recognizing at an early age the ability to create your own path in life.

The importance of keeping a clear focus at the early stages of a new company.

How Jesse founded WeWork Labs.

Just get started and go.

The lessons from actively helping grow a $16 billion company.

Why long term vision is so important for the founders of companies.

What is next for WeWork Labs.

The intersection of community building and being an investor.

The future of Venture Capital.

Ambition Today Question of the Day™:

“What does Ambition mean to you and how has it driven you?”

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

David S. Rose Explains How The New Startup Crowdfunding Rules Affect You & His New Book The Startup Checklist

On this episode of Ambition Today David S. Rose explains his new book The Startup Checklist, how the new startup crowdfunding rules affect you & angel investing 101.

David Rose, The Startup Checklist

On this episode of Ambition Today David S. Rose explains his new book The Startup Checklist, how the new startup crowdfunding rules affect you & angel investing 101. A third generation serial entrepreneur, David's new book The Startup Checklist which is now a New York Times Bestseller. David is also the author of the Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups, as well as the Founder and CEO at Gust.

A man of many titles: Entrepreneur, Angel Investor, Mentor, and Author; David has had an incredible career starting several businesses. Crain's New York Business has called David "the father of angel investing in New York".

Today we learn about how he got started as a founder, became an angel investor, and where he is now as an Author and CEO. We cover the basics of how angel investing in startups works and unpack what the new SEC crowdfunding rules actually mean for startups, your friends, your family and you. We also learn about:

How an Urban Affairs degree enhanced David's views on business.

Why he started Angel Investing.

How NY Angels was created.

How do you set the foundation for a great startup company.

Angel Investing 101.

What is an Accredited Investor.

How Title 3 of the JOBS Act impacts startups and you.

What the new SEC crowdfunding rules mean if your income or net worth is below $100k.

What the new SEC crowdfunding rules mean if your income or net worth is above $100k.

If a founder decides to fundraise from non-accredited civilians, what do they need to know?

What platforms are enabling crowdfunding right now?

How can you invest in startups now.

Ambition Today Question of the Day™:

Why does success matter in the first place? Why not just live a simple life in a fishing town?

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

Patrick McGinnis Tells You How To Be A 10% Entrepreneur And How He Coined The Meme F.O.M.O.

You are not going to want to miss out on this episode! Patrick McGinnis, Author of the 10% Entrepreneur joins Ambition Today for episode fifteen. We talk about the unique ways in which people can engage in entrepreneurship on the side, how to travel the world, and how Patrick coined the term F.O.M.O. (Fear of Missing Out) on the internet.

Patrick McGinnis, Author of the 10% Entrepreneur

You are not going to want to miss out on this episode! Patrick McGinnis, Author of the 10% Entrepreneur joins Ambition Today for episode fifteen. We talk about the unique ways in which people can engage in entrepreneurship on the side, how to travel the world, and how Patrick coined the term F.O.M.O. (Fear of Missing Out) on the internet. Patrick went from growing up in the small blue collar town of Sanford in Maine to visiting over 70 countries, investing in several companies with AIG Capital, co-founding his company Real Influence, and now publishing his book.

Leaving Maine, Patrick went to Georgetown for International Economics which eventually lead to an entire year being paid for to live in Argentina. After his time abroad he came back to work in Latin American investment banking on Wall Street in New York City. When his position was dissolved he then re-evaluated his role in finance and went on to Harvard Business School before joining AIG Capital. At AIG Capital Patrick focused on investing in early stage startup companies. He later founded, Real Influence, a company which enabled branded video partnerships for early Youtube stars. That experience taught Patrick the lessons he shares now in the 10% Entrepreneur. From Patrick’s life we also explore:

Overcoming the local hometown mentality when leaving your hometown.

The value of traveling the world and living abroad.

What to do when you find yourself in a life threatening situation.

How Patrick went from Wall Street analyst to Venture Capitalist.

The impact being at AIG during the 2008 financial crisis had on Patrick’s life.

What stress can do to the body long term when you let it build up.

Overcoming Turrets syndrome and what other people think.

Making the leap from investor to founder.

Selling something for the first time.

What does it mean to be a 10% Entrepreneur.

How partnering with people can expand yourself outside your comfort zone.

How do you get a book deal.

Coining the word term F.O.M.O. (Fear of Missing Out) on the internet.

Learning resilience at an early age.

Ambition Today Question of the Day:

What was the gold standard “norm of jobs” when you were growing up that your friends and family accepted as a good job to have, but you didn’t?

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors

Toptal

Audible.com

2016 Startup Funding Trends With Adeo Ressi

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Adeo Ressi at Valley in Berlin 2016

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Alex Konrad recently gave us some insight on Ambition Today and now today we have a more in-depth explanation of what is happening from Adeo Ressi, the founder of the Founder Institute. Last month Adeo was in Germany for the "Valley in Berlin Summit" and keynoted a talk around the 2016 Startup Funding Trends we are currently seeing. If you are thinking about fundraising, have a startup, or plan on starting your own company you are going to want to watch the keynote below.

Ambition Today: Adam Besvinick Teaches The Art of Hustle and How To Break Into Your Dream Role

Venture Capitalist Adam Besvinick explains the value of pure hustle in pursuing his dreams of breaking into the Startup and Venture Capital industry. Recently named to the Forbes 30 Under 30, Adam has invested in several startup companies as Principal at Deep Fork Capital.

Adam Besvinick, Principal VENTURE CAPITALIST aT Deep Fork Capital

Venture Capitalist Adam Besvinick explains the value of pure hustle in pursuing his dreams of breaking into the Startup and Venture Capital industry. Recently named to the Forbes 30 Under 30, Adam has invested in several startup companies as Principal at Deep Fork Capital.

In episode 14 we explore where Adam came from and how that connects to where he is now. Adam started blogging on VentureMinded.Me years ago and created his own track record through taking ownership of his brand. He has always strived to be continually helpful and add value to others. Through that hustle he previously worked his way into a role at Lowercase Capital to learn from Chris Sacca. Afterword Adam was one of the early employees at Gumroad while going to Harvard Business School. Now Adam is Principal at Deep Fork Capital and has invested in several companies across the country, with a focus on New York City and Silicon Valley. We go over what he looks for in great startups, how he used self-marketing to break into venture capital, and also cover:

The influences of growing up around entrepreneurship.

The value of experiencing life abroad.

How to demonstrate your expertise in a given field.

Why self-marketing is important.

How Twitter can create real world connections.

How constantly being helpful to others, leads to opportunity.

His experience at Duke and Harvard.

The differences between Silicon Valley and New York City.

How being an Investor in New York City is beneficial.

What Adam looks for in startups today.

Exploring some of the Deep Fork Capital portfolio companies.

Ambition Today Question of the Day:

How important is networking?

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

Founder Institute New York

Ambition Today: Alex Konrad of Forbes on Harvard, Media, and Startup Venture Capital

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Aside from our discussion around Kanye West's recent discovery of Twitter we explore Alex's journey to now. Alex grew up in New York City, then went on to write at the Harvard Crimson before working at Fortune. Alex now is a staff writer at Forbes and also works on the Forbes Midas List, ranking the top Venture Capitalists of the past year, and the Forbes 30 Under 30, highlighting up and coming creative and business people. Today we talk about Harvard, the future of media, startups and venture capital. We cover a lot in this episode. including:

Getting into Harvard.

Working for the Harvard Crimson news and editorial board.

Why empathy matters so much in today's world.

How Alex got his start at Fortune working on the Fortune 500.

The relationship between print and digital articles in 2016.

When to go outside your "swim lane".

How to become a real New Yorker?

The advantages of the New York Tech Scene.

Writing the Forbes Midas List and Forbes 30 Under 30.

How large tech companies grow global startup ecosystems.

What global cities are up and coming for startups.

Why are the Venture Capital markets slowing down.

The best way to get media attention for your brand.

Ambition Today Question of the Day:

How important is self marketing?

Links from this episode:

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

State of Startups Report: 2015

First Round Capital has released their 2015 State of Startups Report. They asked the question "What does it mean to be a startup entrepreneur in 2015?". The report was designed to share meaningful insights into what it's like to run a startup today.

First Round Capital has released their 2015 State of Startups Report. They asked the question "What does it mean to be a startup entrepreneur in 2015?". The report was designed to share meaningful insights into what it's like to run a startup today. The full report is above.

The key takeaways from the First Round Capital State of Startups Report 2015 include:

- Most think it won’t get easier to raise funding.

- 73% say we're in a tech bubble.

- No one has a clue about the IPO market.

- Women-led companies are more diversity focused.

- Founders see power shifting from entrepreneurs to investors.

- Hiring the right people and revenue growth top the list of founder concerns.

- Co-founder relationships change with age.

- Bitcoin is overhyped while autonomous vehicles are underhyped.

- Founders fear long-term failure, but not the short-term mistakes that lead to it.

- Elon Musk is the far-and-away most admired leader in technology.

If you are a startup founder let me know on Twitter or in the comments below what you think some of the biggest lessons learned from running your startup in 2015 is.

Ambition Today: Jeff Wald, Co-founder of Work Market, talks Harvard, NYPD, Venture Capital, Startups, and Mentoring

On episode eight Jeff Wald, Co-founder and President of Work Market and his incredibly charitable no shave Movember mustache join Ambition Today. "The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald, Work Market

On episode eight Jeff Wald, Co-founder and President of Work Market join's Ambition Today.

"The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald’s background is nothing short of impressive. He started at Cornell University and then went to J.P. Morgan. He then went back to school at Harvard for an MBA. After Harvard Jeff spent time at Glen Rock Group before going on to Co-found Spin Back. The wild ride of Spinback, his first startup, took Jeff to almost moving back home after coming close to running out of money. The answer was to rebuild the business which later ended up getting acquired. After acquisition Jeff went to Barington Capital Group, and finally to his current company where he is the Co-founder and President of Work Market. Did I mention he was also an auxiliary member of the NYPD as well? This is an episode packed full of insights:

Is getting a Master's of Business Administration worth the return on investment?

Should you start a company or get an MBA?

The value of spending time with Entrepreneurs.

How to break into Venture Capital.

Leaving a job in Venture Capital to start a new company.

How to attract high quality investors in your startups such as Fred Wilson from Union Square Ventures, Spark Capital, and Softbank.

The one question you should start every meeting with.

The four different types of conversations.

Differences between Advisors and Mentors.

The importance of giving back to others

The Ambition Today Question of the Day:

Who would win in a fight, Batman vs Superman?

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Links from this episode:

Work Market, Acquired by ADP

@JeffreyWald on Twitter

Why I Mentor by Jeff Wald in the Huffington Post

NYPD Blue -- What I Learned About Startups Patrolling the Streets of New York City by Jeff Wald in the Huffington Post

NYPD Auxiliary Officer program

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

How Startup Funding Works

If you have ever wondered how startup funding works and what it would be like to go through this process of raising venture capital and angel investor money to fund your startup, well wonder no more

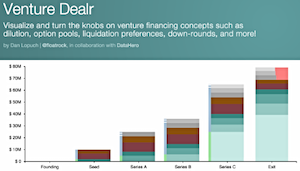

Venture Dealr

Most entrepreneur's are constantly looking to get their startup funded, starting from the very time of conception. The reality is that funding is just one part of a startup's life. Team, product, and execution are almost always more effective and powerful tools in a founder's arsenal than only throwing money at the problems your company working to solve.

Let's say though, that for the sake of this post, you got your company off the ground and funded. You even attracted enough investors to raise a Series A, B, and C too. Nice work! Then, some time after that you even exited your company as well! Impressive, I think you have the hang of this startup thing.

If you have ever wondered how startup funding works and what it would be like to go through the process of raising venture capital and angel investor money to fund your startup, well wonder no more. Dan Lopuch and the team at Data Hero have created the "Venture Dealr". A pretty sharp Github project that allows you to visualize and turn the knobs on venture financing concepts such as dilution, option pools, liquidation preferences, down-rounds, and more. So go ahead, take your startup and shoot for the moon by clicking the button below.