How To Pay Your Annual Delaware Tax For Corporations

"In this world nothing can be said to be certain, except death and taxes."

— Benjamin Franklin, in a letter to Jean-Baptiste Leroy, 1789

Learning to pay your taxes as an individual is complicated and confusing. For first time founders, learning how to pay your corporation taxes can be just as confusing. The state of Delaware website has tons of information but it's user experience wasn't exactly designed by Jony Ive. With the Delaware annual filing deadline coming up the question of what is going on here is a something I am hearing a few times from first time founders.

To offer some guidance I wanted to gather all the information and links you need understand filing your Delaware Corporations Annual Report and paying it's due taxes. The Delaware annual report due date to file without late fee's is before the March 1st deadline annually.

Disclaimer: I offer this post only as helpful guidance as I am not a lawyer or certified accountant. You should still research on your own and consult your accountant if you are uncertain of the process for paying a Delaware C-Corporation Annual Tax.

This information will help Delaware C Corporations file their "Annual Franchise Tax Report" and pay the amount due. Please note that the online portal to file and pay your Delaware taxes is not open 24/7, therefore you should not wait to the last minute to file. It is open between 8:00am and 11:45pm Eastern Time. For filling your Federal Annual Report with the United States IRS please note it is a separate process from the below.

FILE YOUR DELAWARE ANNUAL TAX REPORT AND PAY BUSINESS ENTITY TAX

Go to the Pay Taxes page on the Delaware Division of Corporations website: https://corp.delaware.gov/paytaxes.shtml

Review and understand that there are two methods of calculating the Delaware annual franchise tax tax that is due. One is "Authorized Shares Method" and the other is "Assumed Par Value Capital Method". They are both explained here: https://corp.delaware.gov/frtaxcalc.shtml. I will be showing you the "Assumed Par Value Capital Method".

On the Pay Taxes page click "Pay Taxes/File Annual Report"

Enter 7 digit Business Entity File Number. If you are not sure what your is you can search for it. When inputted press continue.

Click "File Annual Report" for the year you are filing for.

You will now see the "Annual Franchise Tax Report" for you to fill out.

If you applied for (link here) and have received a Federal Employer Id Number or EIN (for short) put that in the "Federal Employer Id" field. It is not required though for state taxes, so don't worry if you don't have one.

On the top right you will see the Franchise Tax amount. It will most likely default to $180,000 (the most your taxes can be in Delaware, $400 is the minimum). Don't worry again as you will most likely recalculate this amount while filling out the report.

Below that you will see the Stock Information that Delaware has on file for the company. This is where your most up to date capitalization table is going to be useful for you to reference. You are going to need to know the number of "Issued Shares". Look it up on your cap table and input it.

Now input the "Gross Assets" of the company. The Division of Corporations FAQ page gives some information on how to report this.

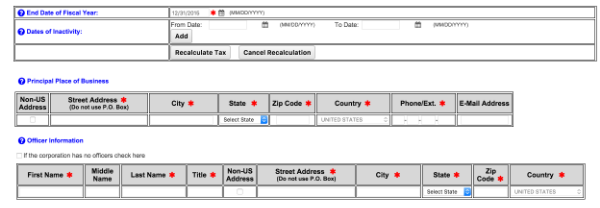

Put in the "End Date for the Companies Fiscal Year". Most likely 12/31/YYYY.

Include "Any relevant Dates of Inactivity" for the company.

Click "Recalculate Tax".

The amount of Franchise Tax due on the top right of the report should have now updated to a new dollar amount.

Now finish filling out the form by adding:

Principal Place of Business: address, phone, and e-mail

Appointed Officers: name, title, and address

Directors: name and address

Authorization Section: date, name, title, and address

Check over all the information you have input to ensure its accuracy.

Read the terms and conditions and then check the box confirming you have done so.

Press "Continue Filing".

Review the copy of the information you entered.

I highly recommend you print a copy of the information you entered for your records. You will thank yourself when you have that information handy one year from now to reference.

Proceed to payment.

Enter your payment information.

Submit.

And you are done! You have now paid your Delaware Franchise Tax and filed your C-Corp’s Annual Report. If you still have questions the FAQ page from Delaware Division of Corporations can be found here and maybe helpful: https://corp.delaware.gov/taxfaq.shtml. If you still have questions or see any mistakes in the above, please put them in the comments below. Between either myself and the combined wisdom of all the other readers I am sure an answer is only a link away.